Let's go old age: matkapital is being withdrawn from pension savings

More and more Russians are refusing to allocate maternity capital to pension savings — in the first nine months of 2025, the amount of funds transferred to other purposes has doubled, according to the report of the Accounting Chamber, which was studied by Izvestia. Families are increasingly withdrawing certificates and investing money in housing and education. The main reasons are the need for funds "here and now", rising prices, and a decrease in confidence in long—term pension instruments. How to dispose of the mother capital more profitably is in the Izvestia article.

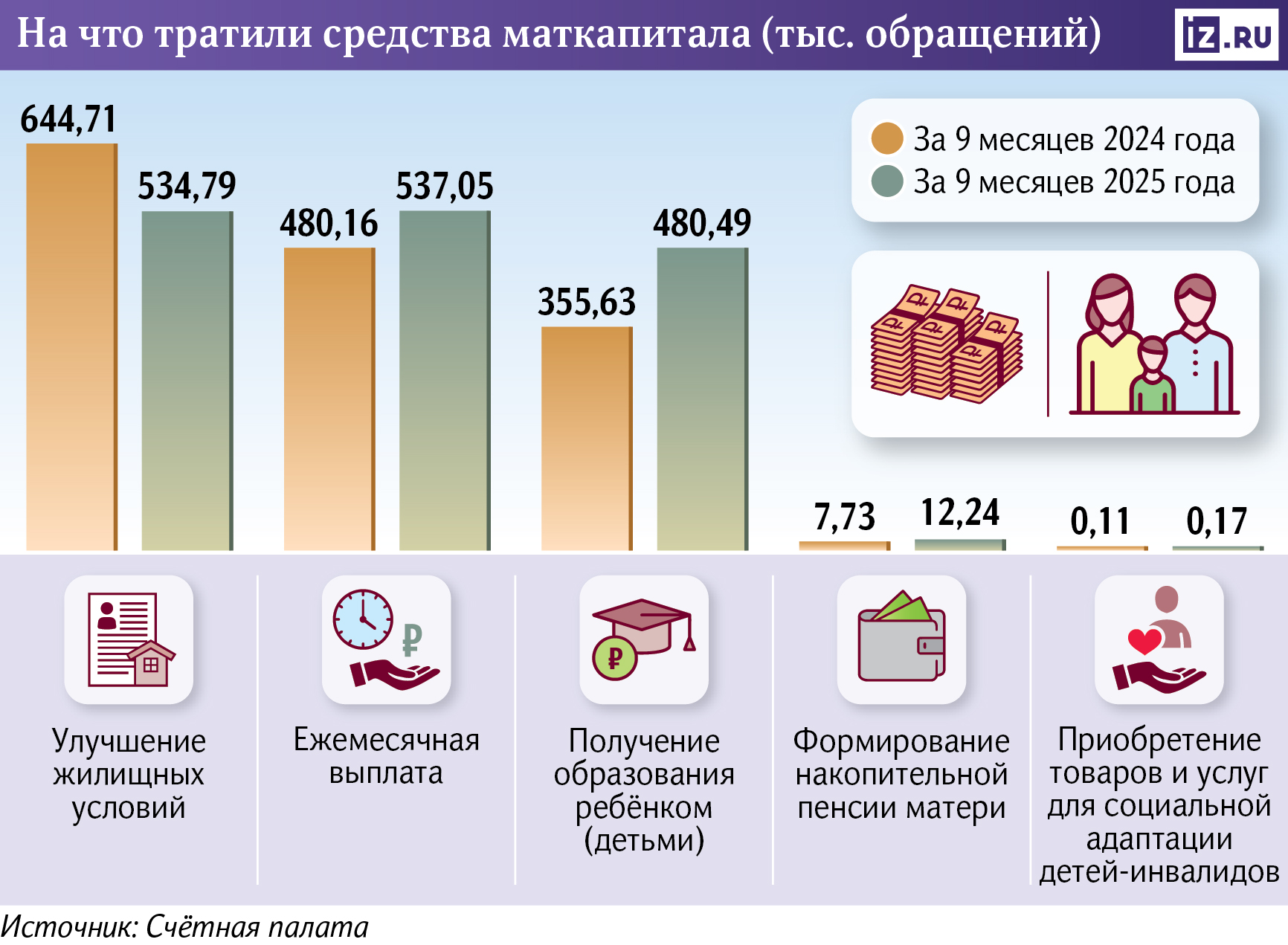

What do Russians spend their mother capital on?

In the first nine months of 2025, Russians redirected 27 million rubles of maternity capital previously invested in a funded pension to other purposes. This is twice as much as last year. Such data is provided in the report of the Accounting Chamber on the implementation of the budget of the Social Fund for January – September 2025, which was reviewed by Izvestia. The editorial board sent a request to the SFR.

Pension savings were formed by Russians, for whom employers transferred 6% of their salaries to individual personal accounts in 2002-2013. Since 2014, there has been a moratorium known as the "freeze" of the funded part of the pension: companies no longer send such contributions, and all funds go only to the insurance system.

The accumulated savings continue to be invested, so the amounts on citizens' accounts are increasing. You can also add the funds of the parent capital to them at the request of the certificate holder. If a citizen has changed his mind about sending this money to form a pension, he can apply for a refusal to the Social Fund, through the MFC or the Gosuslugi portal, until payments are scheduled, explained Yulia Dolzhenkova, a professor at the Financial University under the Government of the Russian Federation. After that, the person has six months to choose another way to use the certificate.

The growing number of refusals is due to the fact that families are increasingly focused on solving current and more tangible tasks, said Yaroslav Kabakov, Director of Strategy at Finam IC. Against the background of high housing costs, increased debt burden and daily expenses, the certificate is perceived as a source of "long" money, which is more rationally directed to improving housing conditions or paying for children's education — investments with an understandable and relatively rapid effect on the quality of life of the family, the expert noted.

Housing and education remain the most profitable areas of using maternity capital, as they allow us to solve acute and current social problems, Yulia Dolzhenkova believes. The funds can be used for the initial payment on the mortgage, its early repayment, purchase of housing, construction or reconstruction of a house, as well as payment for children's education.

Education is now rapidly becoming more expensive. In November, its value increased by 11.4% year-on-year, which was almost twice the total inflation rate for that month, said Natalia Milchakova, a leading analyst at Freedom Finance Global.

In most cases, young families with children can purchase new high-quality housing only with the help of a mortgage. If the household does not meet the conditions of the preferential program, one of the parents has to apply for a loan at extremely high market rates, the expert added. Even with participation in the preferential program, the maximum loan amount is 6 million rubles, and in the capital regions — 12 million rubles, which is often not enough against the background of a significant increase in the cost of new buildings, she stressed.

The funded part of the pension is perceived as "money for later," and taking into account inflation, even after ten years their real value will be completely different, said Ekaterina Kosareva, managing partner of the VMT Consult agency.

How is it more profitable to save for retirement

As a rule, the share of maternity capital allocated to pension savings does not provide a noticeable increase in future payments, Yulia Dolzhenkova noted. In 2025, the certificate for the first child is about 690 thousand rubles, and for the second — 912 thousand, if the payment for the firstborn has not been previously issued.

According to the expert, frequent changes in the pension system in Russia reduce the trust of citizens. In addition, the majority of Russians, especially young people, are not inclined to plan their retirement in advance, preferring to close urgent tasks as they appear, Yulia Dolzhenkova pointed out.

The share of applications for the transfer of maternity capital to pension savings remains minimal — about 0.2% of the total amount of used certificate funds, Ekaterina Kosareva from VMT Consult recalled. According to her, there are more profitable tools for creating a financial cushion "for old age," in particular, the long-term savings program (RSP), which allows you to save for retirement or major goals with government support, with tax deductions and investment income.

At the same time, the profitability of investments in non—state pension funds increased significantly in 2024-2025 - at the level of 12-13% per annum, noted Natalia Milchakova from Freedom Finance Global. With independent savings on deposits, you can get even more — on average, more than 20%. This could also push families to decide to save for the future at their own expense, rather than the parent capital.

At the same time, the widespread orientation among young people towards abandoning long-term planning and withdrawing maternal capital from savings in the future may lead to a decrease in their financial security in old age. Especially given the interruptions in the work history, this practice can increase the burden on the social support system, says Yaroslav Kabakov from Finam.

Переведено сервисом «Яндекс Переводчик»