Things are getting worse: a third of companies in Russia have become unprofitable

Almost a third of Russian companies turned out to be unprofitable in the first half of 2025 — this is the maximum since the pandemic, Izvestia calculated according to Rosstat. If in recent years the share of enterprises in the red has decreased, now the trend has turned around: losses were recorded by 19 thousand organizations. The main reasons are expensive loans, weak demand, rising taxes, sanctions and increased costs, including against the background of higher salaries. Coal mining companies, as well as businesses in housing and communal services, transportation, and scientific research, were the hardest hit. Which industries remain stable and what can change the situation — in the Izvestia article.

Why is the share of unprofitable companies in Russia growing?

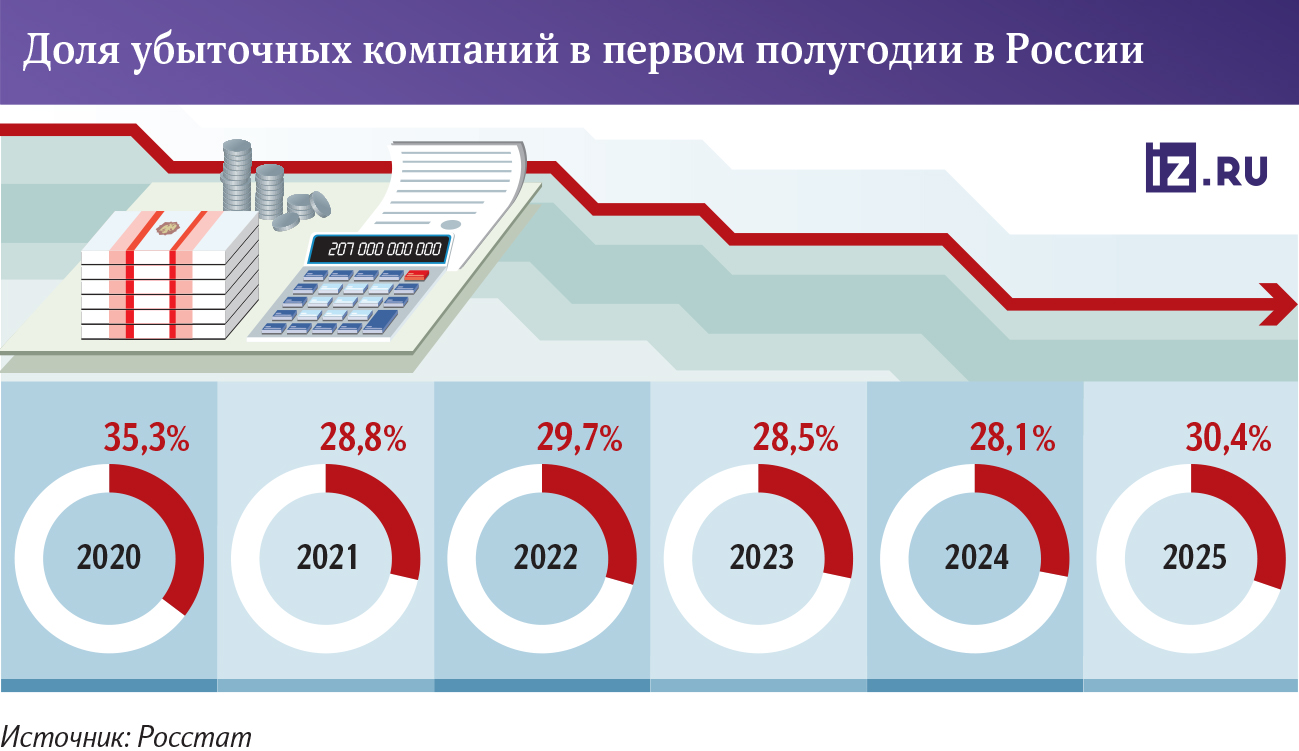

In the first half of 2025, the share of unprofitable organizations in the Russian Federation (excluding small and medium-sized businesses, financial and government structures) increased by 2.3 percentage points and reached 30.4%. This is the maximum since 2020, when 35% of companies went into negative territory due to the pandemic and the massive transition to online. At the same time, in recent years, the share of enterprises with a negative result has been decreasing, Izvestia calculated according to Rosstat.

According to statistics, 43 thousand organizations made profits in the amount of 18.4 trillion rubles in six months, while almost 19 thousand companies made losses in excess of 5 trillion.

— In most developed countries, the share of unprofitable companies ranges from 10-20%. The 30% figure is a high level, although not unique to emerging markets in times of crisis. The optimal norm is considered to be no higher than 15-20%. Thus, the current third indicates systemic problems with the profitability of a number of industries," said Vladimir Chernov, analyst at Freedom Finance Global.

The global economy has changed significantly over the past 30 years: Today, more than 40% of fast-growing companies remain unprofitable, as their development is primarily supported by equity, added Alexey Kurasov, Head of Corporate Finance at Finam.

The main reason for the increase in the number of unprofitable companies is the high key interest rate, which increased debt servicing costs (in the first half of the year it was kept at 20-21%, in August it was lowered to 18%), explained Sergey Katyrin, President of the Chamber of Commerce and Industry (CCI). Additionally, the business is under pressure from rising costs and rising logistics costs, as well as changes in tax legislation that came into force in early 2025, in particular, the profit tax was raised from 20% to 25%. As a result, profitability has significantly decreased in many industries, the expert added.

In addition, this trend is largely due to an increase in nominal salaries: they increased by 15% over the year, Anastasia Priklyova, Associate Professor of the Department of International Business at Plekhanov Russian University of Economics, recalled.

The indicator has a standard pronounced seasonality, the press service of the Ministry of Energy clarified to Izvestia. The first half of the year is characterized by increased values, and by the end of the year, a decrease is recorded, including due to payment schedules under contracts.

In addition, the dynamics in various industries depends on a large number of factors, including the demand for products and the pace of reorientation to new markets, the ratio between the tariffs of resource-supplying organizations in the housing and communal services sector and the cost of energy, the department added. It also depends on the effectiveness of the implementation of investment programs to upgrade equipment.

Which companies have the biggest losses in 2025

According to Rosstat, the largest losses are recorded in coal mining, production and distribution of steam and hot water, water supply and sanitation, as well as in the field of waste disposal. Overland passenger transport and scientific research are among the unprofitable ones. In these industries, up to half of companies or more are in the red.

In the coal industry, global demand problems and China's imposition of tariffs have become a key factor in falling revenues, explained Alexey Kurasov from Finam. The pressure was also increased by the increase in Russian Railways tariffs, the limited capacity of the Transsib and the high creditworthiness of companies against the background of an increase in the key rate.

— External pressure on metallurgy in Russia reduces the demand for coking coal. An additional factor was the increase in natural gas supplies to China, which partially displaces coal companies from this market," added Anastasia Priklyova from the Russian University of Economics.

The fall in prices on the global market due to the transition to green energy also played a role, said Vladimir Chernov from Freedom Finance Global.

In the housing and communal services sector, the situation was complicated by the fact that tariffs were indexed much slower than the actual costs, especially for labor, Alexey Kurasov continued. Additional pressure is created by a moratorium on debt collection accumulated until October 2022, which is valid until January 2026.

As for transportation, the problems affected the entire logistics, the expert added. Contracts are signed for a long time, while costs are rising: salaries are increasing, maintenance of foreign machinery and equipment is becoming more expensive, and the cost of loans is increasing. At the same time, a significant part of the transport was purchased specifically on lease, which increases the financial burden.

At the same time, the scientific research sector is suffering from a reduction in grants and investments, Vladimir Chernov emphasized.

At the same time, the least unprofitable industries, according to Rosstat, include the production of paper, rubber and plastic products, textiles, medicines, as well as wholesale trade. In these segments, the share of companies that go into negative territory does not exceed a quarter. These areas are supported by demand and relatively low capital intensity, explained Vladimir Chernov.

Positive results are shown by the IT industry, which annually receives over 1 trillion tax benefits, Alexey Kurasov added. Industrial production and mechanical engineering, especially in the military—industrial complex segment, are also doing well - company revenues have increased two to three times.

— Construction and production of durable goods such as cars, household appliances, and industrial equipment remain under pressure. There is too much competition with China, whose distributors' warehouses are already overcrowded," the expert noted.

What does the growth of business losses lead to?

An increase in unprofitability leads to a decrease in tax revenues, a drop in investment activity and an increase in the debt burden, Vladimir Chernov estimated. This increases the pressure on banks, which are forced to restructure loans more often, and on the government, which supports unprofitable industries through subsidies. In the long run, such trends can slow down economic growth and increase structural imbalances.

"Without stimulating investment in modernization, it also threatens to increase bankruptcies and accelerate inflation, because the "surviving" companies will raise prices," warned Alexey Kurasov from Finam.

If the current macroeconomic conditions persist, the share of unprofitable enterprises will grow, says Sergey Katyrin from the Chamber of Commerce and Industry. According to him, the situation can be mitigated by reducing the credit burden, fiscal easing for individual industries and expanding government support measures where necessary.

The situation may stabilize in the second half of the year, predicts Daniil Gonenko, Associate Professor of Economics and Finance of the Public Sector at the Presidential Academy. This should be helped by lowering the key interest rate, speeding up payments in the public sector, expanding factoring (selling debts to banks) and guarantees. For the municipal infrastructure, an additional driver will be the launch of long-term modernization programs.

— The main risk of growing unprofitability is that companies will start postponing investment projects, equipment upgrades and technology implementation. This will hit contractors from small and medium—sized businesses and lead to risks to employment and productivity in the field, the expert warned.

To reverse the trend, it is necessary to accelerate institutional changes: to link financing with contracts and technologies, to give medium-sized businesses access to working capital and long-term demand, Daniil Gonenko believes. Then the growth of unprofitability will be stopped, and the current surge will be temporary.

Переведено сервисом «Яндекс Переводчик»