- Статьи

- Economy

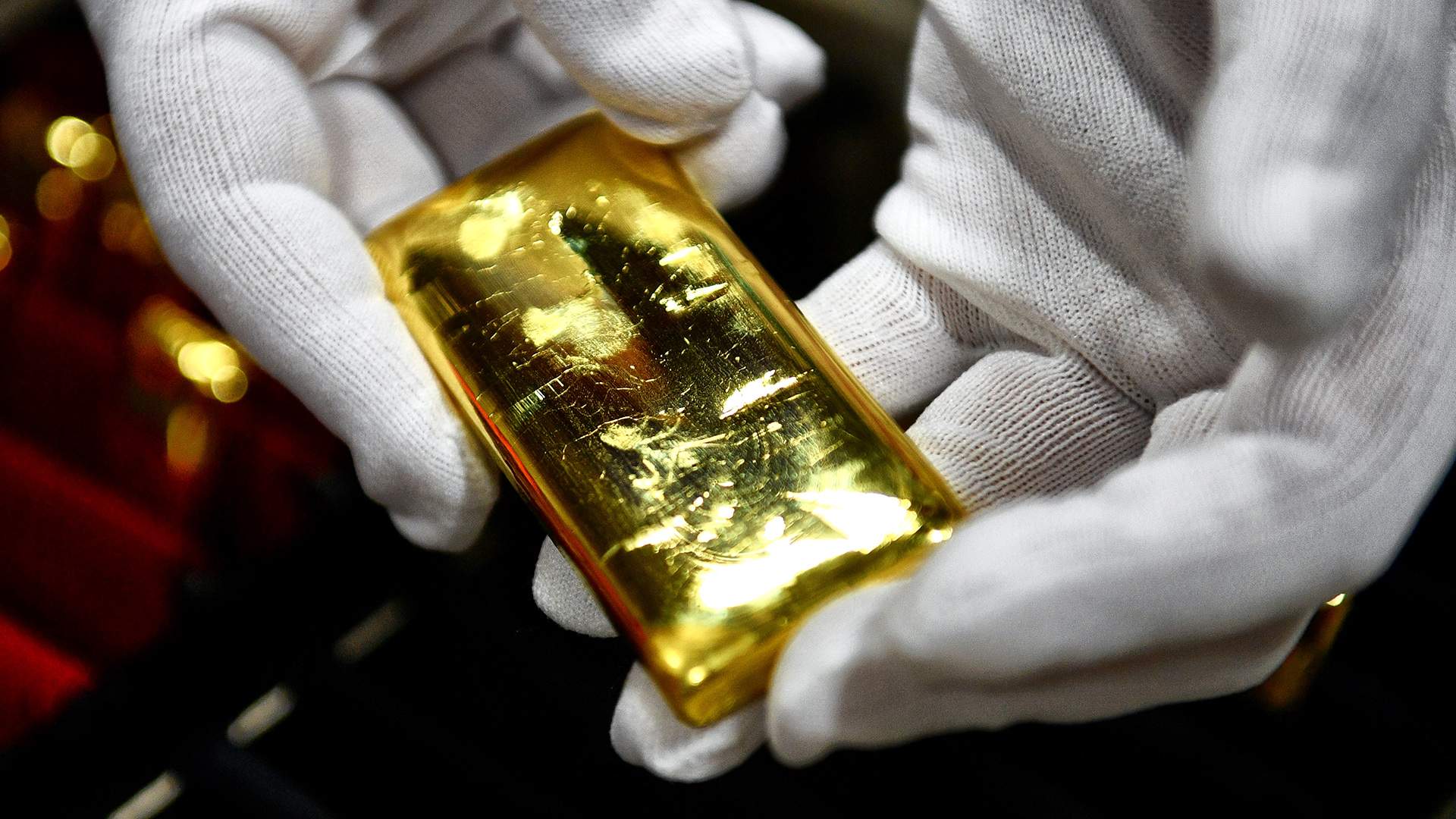

- Protect the asset: the volume of the illegal gold market in the Russian Federation was estimated at 20%

Protect the asset: the volume of the illegal gold market in the Russian Federation was estimated at 20%

The illegal precious metals market in the country is growing, according to the materials of the Ministry of Finance. For gold, it has already reached 20% — about 7 tons per year, experts estimated to Izvestia. Against this background, the authorities intend to tighten control over the turnover of investment coins from precious metals — the draft resolution was prepared by the Ministry of Finance. Banks and other market participants will be required to enter information on coin balances and turnover into a special state system, as well as personal data of customers during any transactions (purchase and sale, pledge, storage). Whether this will help whitewash the market is in the Izvestia article.

What is the volume of the illegal precious metals market

The number of counterfeit jewelry is growing in Russia, the degree of imitation of precious metals and stones is increasing, as well as the spread of counterfeit goods, according to the materials of the Ministry of Finance.

In 2024, the Russians purchased 34.4 tons of gold. There are no official statistics on the volume of the illegal market, but now it has reached about 20% of the legal market, experts estimated Izvestia. That is, it amounts to about 6.5–7 tons of precious metals per year, said Vyacheslav Mishchenko, an expert at the Presidential Academy. This includes both illegally mined gold and transactions that are conducted "past the cash register" to preserve anonymity.

The illegal turnover of jewelry and precious metals has reached about 50% and 20% of the official market, respectively, agrees Ilyas Zaripov, Associate Professor of the Department of Global Financial Markets and Fintech at Plekhanov Russian University of Economics. A similar assessment was given by independent expert Andrey Barkhota.

Against this background, the authorities intend to tighten control over the turnover of investment coins made of precious metals. Such a draft resolution was prepared by the Ministry of Finance (Izvestia analyzed it). It concerns the turnover of gold, silver, platinum and palladium coins acting as a means of payment.

According to the document, firstly, credit institutions will have the obligation to collect personal data of customers and transfer them to the State Information System for Accounting for Precious Metals, Precious Stones and Products Made from them (GIIS DMDK). It will need to upload not only data on the purchase and sale of assets, but also information on the conclusion of any other transactions related to turnover, explained Ruslan Kuleshov, CEO of the Clean Environment law firm.

For example, if a coin is transferred as a pledge, as a contribution, or for safekeeping, then now such an operation will also be transparent and reflected in the DMDK GIA, he said.

Secondly, all sales by banks, pawnshops and dealers (legal entities or individuals engaged in the purchase, sale and exchange of coins) will have to be carried out with the mandatory use of cash register equipment (KKT) integrated with the GIIS DMDK module, said the head of the public organization Center for Law and Order in Moscow and the Moscow region." Alexander Khaminsky. Now it is used selectively, Ruslan Kuleshov noted in his turn. Banks will also have to transmit to the state system data on coin balances, their turnover, and their entry or withdrawal from circulation. The Ministry of Finance offered to provide access to the state system to the Ministry of Justice.

Why is it necessary to tighten the turnover of coins?

The illegal gold market in Russia is growing, said Ilyas Zaripov, Associate Professor of the Department of Global Financial Markets and Fintech at Plekhanov Russian University of Economics. He explained that business and public interest in investing in bullion, coins and jewelry is traditionally high, and any shortage of official goods is quickly replaced by counterfeit goods, he said.

An increase in the share of counterfeit products on the market undermines consumer confidence in honest manufacturers and negatively affects the economy as a whole, according to explanatory documents to the draft of the Ministry of Finance.

According to the results of financial monitoring, it was revealed that precious metals coins are used to form transit chains with subsequent cash withdrawal, the press service of the Ministry of Finance told Izvestia. In this regard, a draft resolution has been developed aimed at ensuring transparency of turnover and combating the shadow market, they added.

Back in 2023, the Central Bank revealed operations involving the use of precious metals investment coins for money laundering. The scheme began with transferring funds to a fictitious company that bought the coins, and ended with depositing them in a bank for cash.

It is precisely this scale of the problem that explains the decisive actions of the regulator, said Vyacheslav Mishchenko from the Presidential Academy.

— The abolition of VAT on the purchase of gold by individuals in the Russian Federation in 2022 increased the attractiveness of investments in it, but hardly created conditions for reducing the share of the illegal sector. Given the growing fluctuations in the financial market, as well as the strengthening of monitoring and supervisory functions, precious metals have become one of the coveted investment elements," concluded Andrey Barkhota.

Will tightening control over gold turnover help whitewash the market

For market participants (banks, dealers, pawnshops), the new measures mean an increase in the administrative burden, the need to modernize reporting systems and strict compliance with identification and cash transactions requirements, believes Alexander Khaminsky.

The changes will increase the possibilities for control, allowing you to remotely determine the entire path of an asset and its holder at a specific time, Ruslan Kuleshov said. However, there are disadvantages.

The more strictly any activity in the market is monitored, the greater the administrative burden on its participants, says Vladimir Zboikov, executive director of the Delovaya Rossiya Committee on Precious Metals, Precious Stones, jewelry and Folk Crafts. Working in the legal field is becoming dramatically more difficult, and sometimes it simply becomes impossible, the expert noted.

— It happens that such market participants cannot withstand the administrative burden and go into the shadows. It's good if it's in the "gray" zone (that is, not complying with any mandatory requirements), but taxes and fees come from such turnover. It's worse if it goes to the black market (completely illegal mining or marketing activities), from which the state receives nothing," concluded Vladimir Zboikov.

The retail gold market is a huge but "opaque" sector of private capital, and the government is seeking to take control of it, as it has already done with banks and securities, said Vyacheslav Mishchenko of the Presidential Academy. According to him, the main risk is the technical implementation. The GIIS DMDK system has previously caused complaints due to failures. The expert believes that if it is too complicated, it can harm a legitimate small business rather than help it.

Nevertheless, the illegal market really needs to be reduced. For the economy, the harm from it lies in unfair competition (shadow workers do not pay taxes), and anonymous gold is also used in financial crimes, Vyacheslav Mishchenko said.

The harm to consumers is twofold, he stressed. First, there is the risk of buying a fake without any protection. Secondly, recently there has also been a legal risk: possession and an attempt to sell a coin without documents may entail liability, which turns such an asset into a "toxic" one.

Переведено сервисом «Яндекс Переводчик»