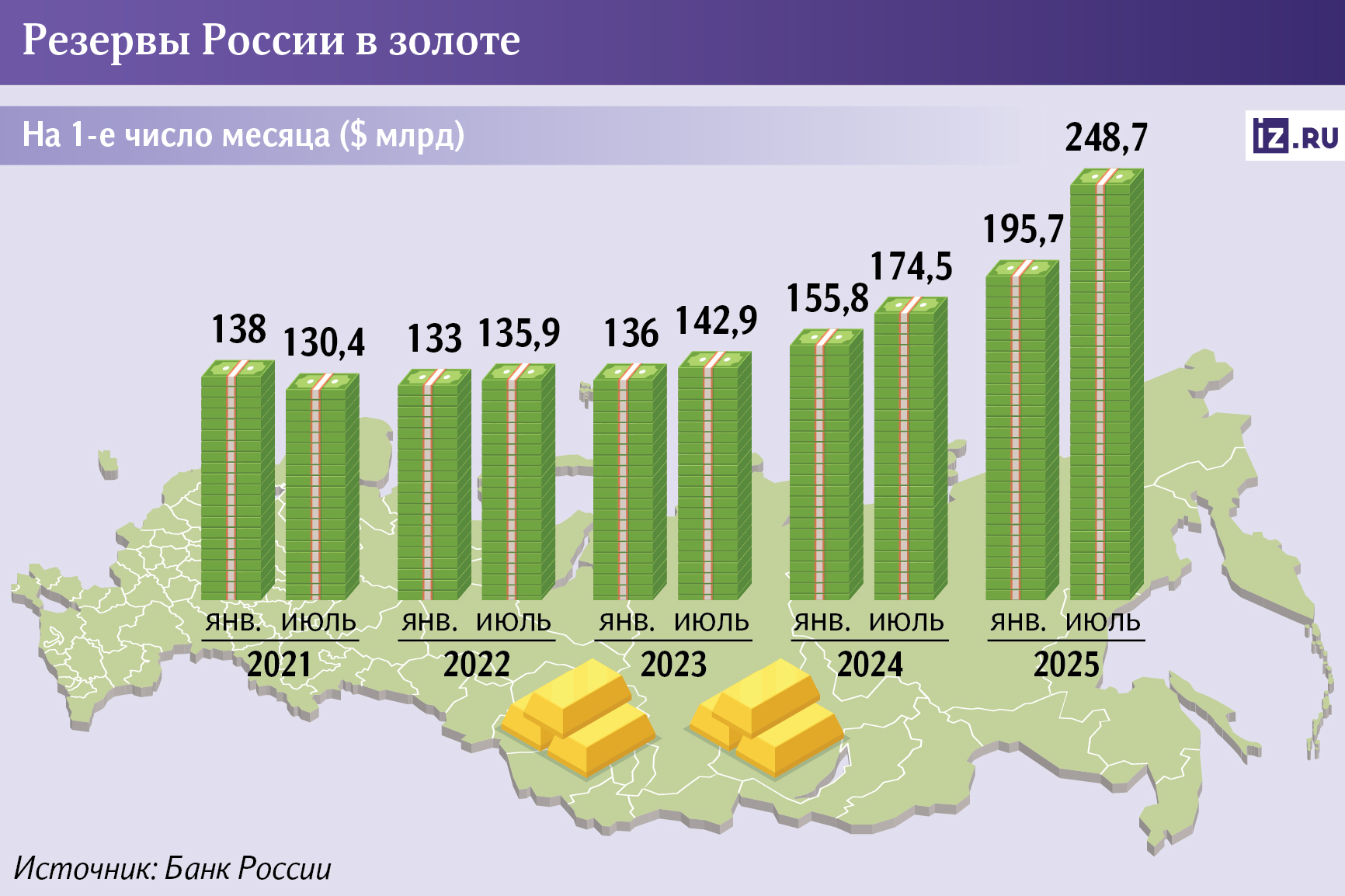

The stock is solid: Russia's reserves in gold have reached a record $249 billion.

Russia's gold reserves have reached a record high of almost $249 billion. This follows from the data of the Central Bank, which was analyzed by Izvestia. Now it is the most reliable asset against the background of the fact that Russia's savings in Western currencies are blocked. Over the past six months, reserves in gold have increased by 27%. The main reasons are the increase in the value of precious metals due to geopolitical uncertainty in the world and the build—up of reserves themselves. The Central Bank is increasing the share of gold in reserves, which has reached its highest level in a quarter of a century in recent months. Whether the price will continue to rise and whether Russians should pay attention to this asset is in the Izvestia article.

Russia's gold reserves in 2025

Russia's international reserves in gold reached a record $248.7 billion in the first six months, according to the Central Bank. Since the beginning of the year, they have increased by 27%, the highest increase in the last 10 years. There was a similar increase only in 2016, but then the total volumes were much lower - only $63.5 billion. Izvestia asked representatives of the regulator about the reason for such an increase.

The assets of the Russian Federation in the main precious metal look impressive against the background of other countries. According to the data of the World Gold Council, which was reviewed by Izvestia, in the first quarter Russia was in fifth place in the world in terms of gold reserves — then it had about $229 billion in reserves. Russia was ahead of Germany ($335.6 billion), Italy ($245.5 billion), France ($244 billion) and China ($229.5 billion). There is no data on these countries for the second quarter yet.

In general, international reserves consist not only of gold, but also of foreign currency assets, in particular, yuan. Their size has increased by 13% since the beginning of the year and reached $688.7 billion, according to the Central Bank. At the same time, the share of reserves in gold is growing. In recent months, it has reached its highest level in a quarter of a century, exceeding 36%.

Gold and foreign exchange reserves are the reserves of the regulator, which include foreign currency, Russian rubles, special drawing rights, reserve positions in the IMF and gold. They are used to maintain financial stability, service external debt, conduct currency interventions, and can also be used to finance the consequences of any emergency, said Vladimir Chernov, analyst at Freedom Finance Global. This is a kind of safety cushion for the country, added Alexey Tarapovsky, founder of the Anderida Financial Group.

Therefore, during a favorable situation, it is advisable to increase reserves, and in conditions of an increasing budget deficit, part of the expenses can be carried out at their expense, independent expert Andrei Barkhota added. They are also used to stabilize the exchange rate and stimulate the economy.

However, in 2022, the West blocked about half of Russia's gold and foreign exchange reserves — about $300 billion. Reserves in gold and yuan remain liquid.

Why is the share of gold in the reserves of the Russian Federation growing?

The growth of gold in international reserves occurs through two channels: through physical growth (when the Central Bank buys the metal and adds it to reserves) and due to an increase in the market price, said Svetlana Frumina, Acting Head of the Department of Global Financial Markets and Fintech at Plekhanov Russian University of Economics.

According to TradingView, in the first six months of this year, the precious metal as a defensive asset has gained about 24%, its price has reached $ 3,330 per ounce.

— At the same time, Russia increased the volume of purchases of physical gold in the country's gold and foreign exchange reserves after the freezing of its foreign exchange assets in the European Union and the United States. Since physical gold is stored inside the country and it is impossible to freeze or confiscate it to other states, the Russian Federation began to purchase large amounts of precious metal and Chinese yuan instead of the previous American dollars and euros," says Vladimir Chernov from Freedom Finance Global.

As Alexey Tarapovsky of the Anderida Financial Group emphasized, the trend of replenishing reserves began immediately after February 2022, when part of the reserves in unfriendly currencies turned out to be frozen. One of the obvious ways out of this situation was gold — it is optimal as a protective asset in conditions of foreign trade restrictions and political instability, he added.

In addition, the purchase of precious metals is a global trend, and other countries are also actively increasing their gold and foreign exchange reserves for financial stability in the event of a crisis, said Vadim Ignatov, senior personal broker at BCS World Investments.

Russia is currently betting on gold primarily because of limited access to foreign exchange reserves, as well as in order to protect against inflation, support its own production, processing and strengthen ruble collateral, Svetlana Frumina from Plekhanov Russian University of Economics believes.

— Gold is a universal and sovereign asset, free from the obligations of issuers and the risk of freezing. Its investment attractiveness is increasing against the background of inflationary expectations and increased volatility in financial markets," the expert added.

Nevertheless, there is a risk of depreciation of the precious metal, but unlike currencies or securities, it is minimal, believes Vladimir Chernov. The main feature of such investments is the impossibility of drastically reducing the value of the precious metal. The constant demand for gold in the industry and its purchases in country reserves make it possible to use such investments as conservative and fairly reliable, explained independent expert Andrey Barkhota.

How much will gold cost by the end of 2025

The rapid increase in the value of precious metals in the first half of the year will result in a slight slowdown by the end of 2025, Andrei Barkhota is sure. According to him, this may reduce the investment attractiveness of gold for private and institutional investors, but there remains a steady demand for the precious metal from investment funds.

Currently, the tariff wars launched by US President Donald Trump, the level of the Fed's key rate (low weakens the dollar, and therefore makes gold a more expensive metal), as well as the geopolitical situation have an impact on the price of gold, said Nikolai Dudchenko, analyst at Finam Financial Group. Demand from the central banks of the countries will remain high, and this to a certain extent supports the gold price, he added.

Experts interviewed by Izvestia believe that the price of gold will rise to $3,500 per ounce by the end of the year.

Переведено сервисом «Яндекс Переводчик»