Golden cutoff: Russians have become less likely to buy jewelry

Sales of gold jewelry in Russia decreased by 10% in the first half of the year, Izvestia calculated based on statistics from the World Gold Council. The demand for such products is falling due to the record rise in prices for the precious metal, as well as against the background of increased savings behavior of Russians. Izvestia investigated how interest in jewelry is changing and what is happening with this market.

How much have sales of gold products dropped

The total weight of gold jewelry sold in Russia in January – June was 15.5 tons. This is 10% less than in the same period of 2024, Izvestia calculated based on statistics from the World Gold Council (WGC). The number of products sold has been minimal since 2022, according to WGC data.

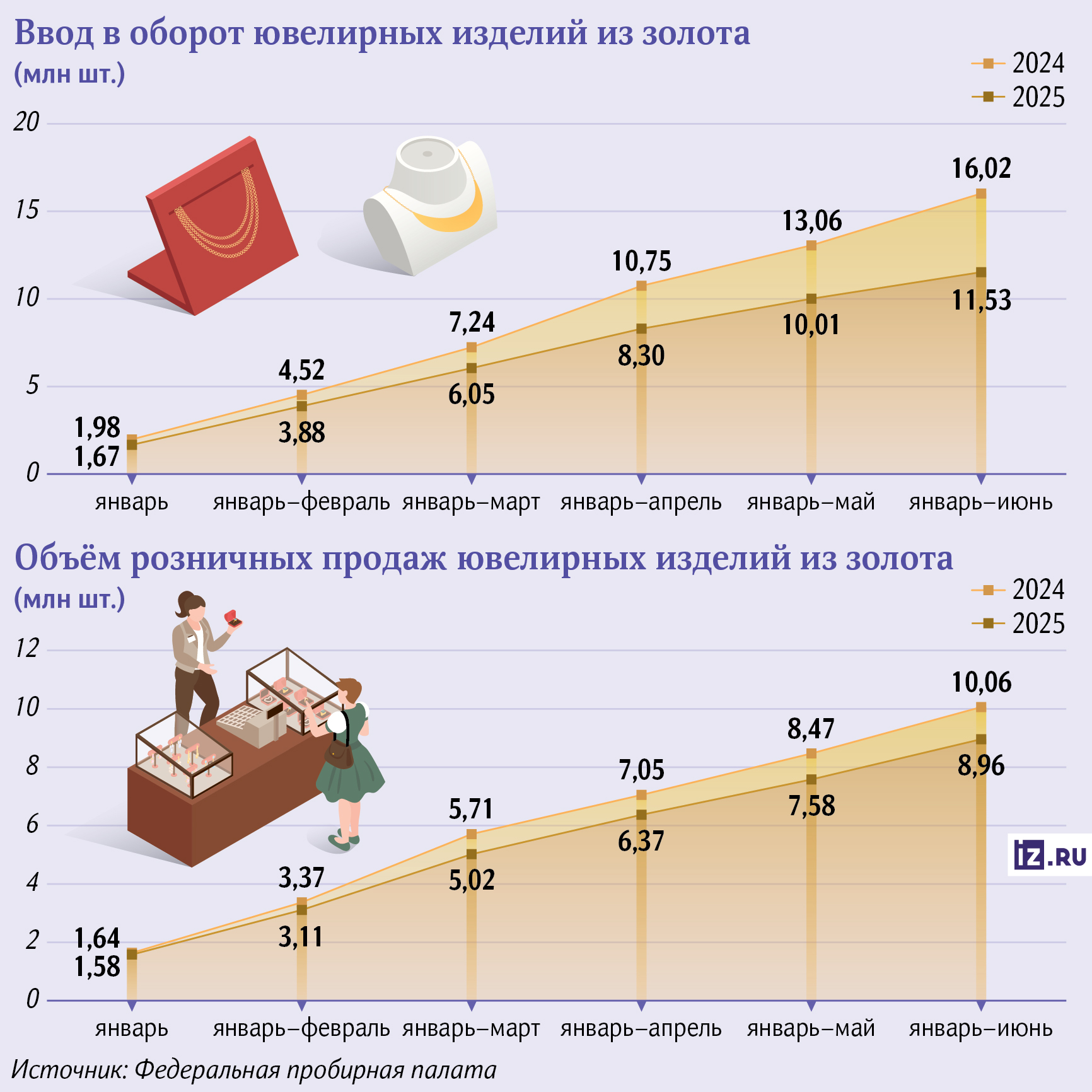

According to statistics from the Federal Assay Chamber, the decline in sales turned out to be even more noticeable: the number of jewelry sold fell by 12.3%, to 8.96 million pieces. In addition, the introduction of new Russian gold jewelry into circulation during the same period decreased by 39%, to 11.53 million pieces.

A similar situation is observed in the world: the total weight of jewelry made of precious metal in the first half of the year decreased by 18%, to 724.4 tons, compared with the same period in 2024. This is the minimum since 2020, according to WGC statistics. At the same time, in monetary terms, the market increased by 16% over the same period, to $71 billion.

Why is there no interest in gold jewelry?

Jewelry sales continued to decline due to record gold prices, according to the WGC materials. Demand for this precious metal in the second quarter of 2025 was 30% lower than the average annual value over the past five years, the document says. The collapse in prices for lab-grown diamonds offset the rise in gold prices, providing "some support" to demand for gemstone products, WGC analysts said.

The average price of gold in January –September was $3,165 per ounce. This is 36.8% more than in the same period last year, according to the data from the Price Index Center. The maximum was recorded on September 12 at $3,651.1 per ounce. Goldman Sachs predicts that the price may reach $5,000 per ounce in a risky case, while the base forecast of the bank's analysts is $4,000 by mid-2026.

Vladimir Zboikov, executive Director of the Russian Jewelers Guild Association, believes that the weight reduction that has been taking place over the past few years has "actually reached its physical limit." The transition to lower-grade gold is hampered by well-established preferences among buyers, he noted.

Consumers are increasingly choosing lightweight gold jewelry, Sokolov CEO Nikolai Polyakov confirmed. This, according to him, is due to both the rise in price of this metal and high deposit rates in banks, which encourage consumers to accumulate.

The slowdown in household income growth also contributes to the decline in sales, Vladimir Zboikov believes.

In August 2025, the consumer sentiment index, according to the Central Bank, decreased by 1.8 points year-on-year, to 103.2 points. Respondents surveyed by the regulator began to assess the status of their financial situation "somewhat worse" over the past year and considered the current moment "less favorable" for large purchases than last month, it follows from the monitoring of the Central Bank..

Rising inflation, instability and uncertainty reduce the consumer's desire to buy luxury decorative goods, which include jewelry, said an interlocutor of Izvestia in a large investment bank. According to him, when people save money, they primarily cut back on such expenses.

Trending and budget silver jewelry traditionally remain the leaders of sales — the share of the latter continues to grow and is already approaching 80%, Nikolai Polyakov said. However, the reorientation towards inexpensive products is observed only among young consumers, adds Vladimir Zboikov. According to the expert, in general, the demand for silver jewelry is also falling, but much more slowly.

The Moscow Jewelry Factory, Sunlight and other major manufacturers did not respond to Izvestia's request.

What awaits the jewelry market

In monetary terms, the Russian jewelry market showed moderate growth in the first half of the year. Its volume increased by 12% year-on-year, to 232 billion rubles, according to Infoline data. This is due to an increase in the cost of the product, explained a source of Izvestia in a large jewelry company.

The key driver of market growth in recent years has been the development of online sales, including through marketplaces, says Nikolai Polyakov from Sokolov.

Sales of these ornaments at Wildberries increased by almost 70% in the first half of the year compared to the same period in 2024, the marketplace reported. The demand for jewelry on Ozon jumped by 53% year-on-year, the company's representative noted. Customers are getting used to buying complex product categories online, which previously required the help of a consultant, he added.

The gold jewelry segment is dominated by rings (+79% year-on-year), earrings (+83%) and chains (+47%), the representative of Wildberries & Russ added. At the same time, the turnover of silver products is about a third higher than that of gold, said a representative of the marketplace. The sales of classic gold (585th grade) and silver rings are growing the most, he said.

The dynamics of the value of precious metals, which are key raw materials for the jewelry industry, has a significant impact on market growth in monetary terms, Nikolai Polyakov added. But with a reduction in the key rate, the situation may change, says Vadim Serov, CEO of the Russian Jewelers' Association. In these conditions, according to him, deposits will lose their attractiveness, and a significant part of the funds will go back to consumption.

— Russia is a country with traditionally high and relatively stable demand for jewelry. Despite the subdued growth in the first half of the year, the final market growth figures will be 13-15%, the expert expects.

Jewelry sales by the end of the year may reach 535-540 billion rubles in money, which is 14% more than in 2024, Infoline predicts.

Переведено сервисом «Яндекс Переводчик»