Empty waiting: price growth in the primary housing market exceeded 10%

Over the year, the average cost per square meter in new buildings in Russian cities with millions increased by 10.3%, analysts told Izvestia. The price rose the most in Moscow, Chelyabinsk and Omsk, with a decrease recorded in eight other major cities. Experts explain the trend by a gradual decrease in the number of mass construction projects. It is not worth expecting a decrease in prices in the event of a loosening of monetary policy - due to an oversupply of demand, the cost may increase significantly. About when housing will become more affordable — in the material of Izvestia.

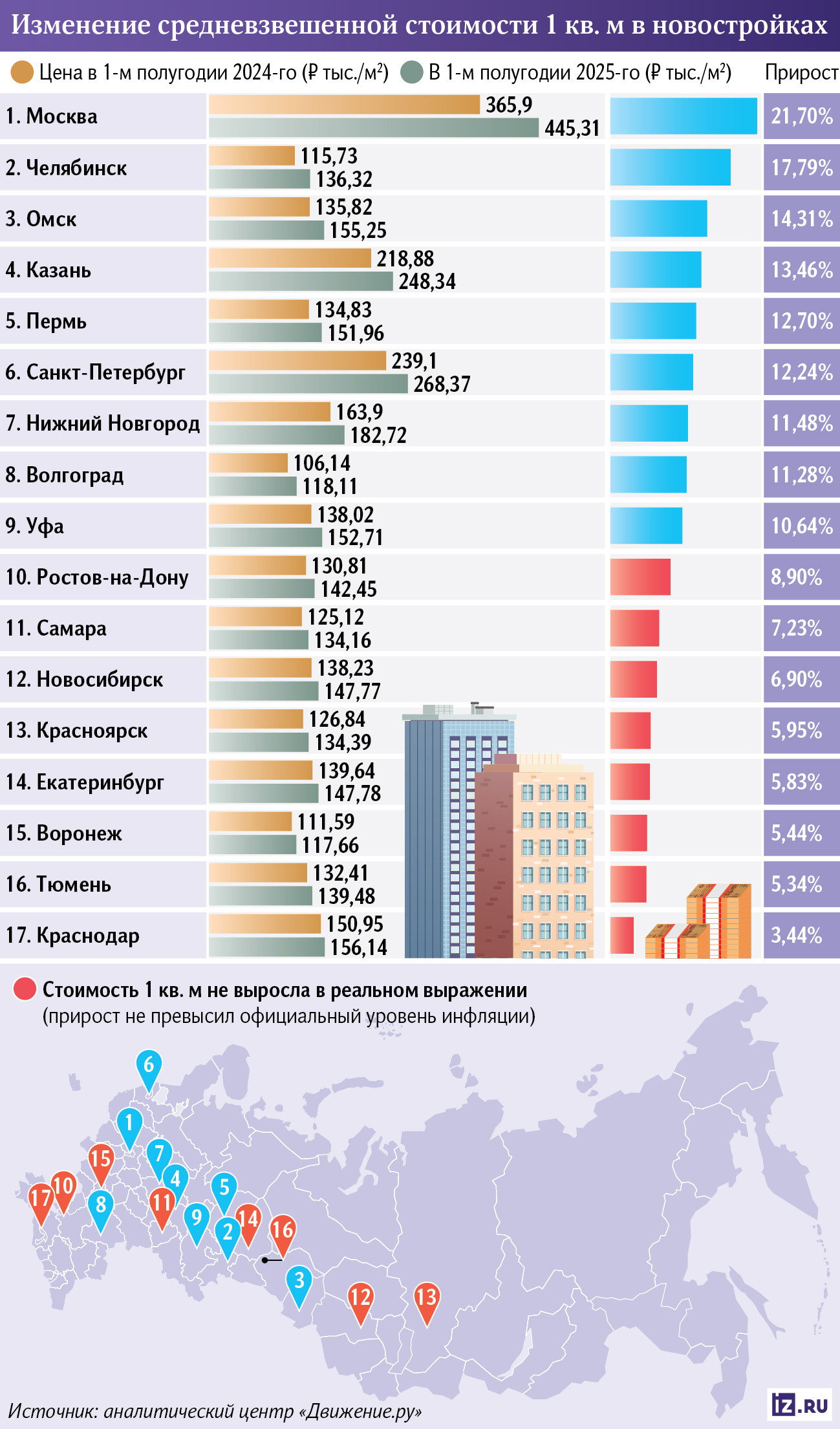

How house prices have increased

Since the cancellation of the basic preferential mortgage program, the cost per square meter in new buildings in Russian cities with a population of one million has increased by 10.3-13.8%, market participants told Izvestia. According to the analytical center "Movement.<url>", this is not much higher than the official inflation rate for the same period.

The price per square meter has increased the most over the past year in Moscow, Chelyabinsk and Omsk.

"In the capital, this dynamic is explained by the gradual leaching of comfort—class projects from the market, as developers move to business class," the analysts explained. — In Chelyabinsk and Omsk, there has been a significant increase in construction volumes and the entry of projects with higher quality characteristics into the market.

The cost per square meter has not increased in real terms in eight major cities: Rostov-on-Don, Samara, Novosibirsk, Krasnoyarsk, Yekaterinburg, Voronezh, Tyumen and Krasnodar.

"In the largest markets — Yekaterinburg, Tyumen and Krasnodar — the primary real estate market is stagnating in terms of price," the experts added.

According to Yandex Real Estate, in July, the median cost per square meter in the primary market in the million-plus cities was 188 thousand rubles, +1.1% for the month. Prices have increased in eight of the 16 megacities, remained at the same level in three, and decreased in five.

— In annual terms, the average cost per meter increased by 11.8%. Ufa, Perm, Chelyabinsk, Moscow and Omsk have become the growth leaders," said Evgeny Belokurov, Commercial director of the service. — We record an annual decrease in median prices per square meter in advertisements for the sale of new buildings only in Nizhny Novgorod.

The most significant increase in the average price per square meter among Russian megacities was recorded in Chelyabinsk (+18.9%), Kazan (+18.7%), Omsk (+17.5%), Perm (+14.8%) and Voronezh (+12.6%), in Moscow over the same period the increase was 9.9%, in St. PetersburgSt. Petersburg — 4.1%, according to the federal company "Floors".

— There are many factors influencing the growth in the cost of housing under construction, including the rise in the cost of labor, against the background of the trends that are observed in the labor market, — said Sergey Zaitsev, sales Director of the company.

Natalia Shatalina, CEO of the RedCat aggregator of new buildings, added that in the old borders of Moscow, prices for the year, excluding the elite and premium segment, increased by 15.8%. Now a square meter costs an average of 491 thousand rubles, and an apartment costs about 26.38 million rubles.

The dynamics of the price per square meter in new buildings in Moscow varies greatly depending on the market segment, the Tekta Group added. Thus, in the business class, the indicator increased by 15.7% year-on-year: as of August 2025, the average cost per square meter reached 581 thousand rubles per square meter. Meanwhile, in the premium segment, prices increased by 42.4%.

In the Moscow region, the cost of the "square" increased 0.3% per month and 2.2% per year, said Alexey Artoshin, commercial Director of Glavstroy Regions.

Why is the cost of new buildings rising?

In many cities, the volume of new facilities entering the market has significantly decreased, which, against the background of the erosion of the most affordable supply, increases the average cost per square meter, explained Konstantin Samedi, Director of Sales at Ortiga Development.

— In addition, in each specific new building, as the construction readiness increases, the cost of the "square" also increases, which can also push the average cost up, — he said.

At the same time, during the year, the only remaining massive preferential housing loan program, the family mortgage, caused an increase in the weighted average area of apartments purchased by Russians. On average, they have become more spacious in most Russian megacities, analysts at <url> added

"The weighted average area of apartments sold by developers across the market increased by 0.5% year—on—year, but the dynamics is mixed across individual cities," they said. — The maximum increase in the area of lots in transactions is noted in Voronezh, Moscow, Novosibirsk and Yekaterinburg. Family mortgages lead buyers away towards larger apartments.

The average lot value in transactions with new buildings in cities with a population of one million increased by 10.8% year on year. In those cities where the weighted average lot area has decreased, it was previously at a fairly high level. For example, in Omsk, Nizhny Novgorod, and Volgograd. Or, as in the case of Kazan, according to experts, it is under pressure from the high cost of housing, that is, buyers are simply not financially ready to purchase large areas.

In Moscow, in addition to economic reasons, the increase in the average price index is primarily due to a change in the supply structure and the reorientation of developers to a higher segment, said Evgenia Vinichenko, Director of Pricing and Analytics at Pioneer.

— If a year ago the share of comfort class in the total volume of exhibited housing was 35%, now it has decreased to 26%, and the shares of more expensive segments, on the contrary, have increased, - she said. — Of the 16 new projects that started in 2025, only two belong to the comfort class, 10 belong to the business class, and the rest belong to expensive housing.

The variation in the cost per square meter is explained by a number of factors, Alexey Artoshin noted. In regions where buyers actively use preferential mortgage programs to purchase housing or are willing to pay for it immediately, demand remains high.

— This provides an opportunity for a moderate increase in the cost per square meter, — he explained. — In other regions, where consumer activity is lower and the percentage of preferential programs is lower, prices rise more slowly or remain at the same level.

In addition, the structure of the offer also affects the average cost. An increase in the share of business and luxury housing automatically increases the "average price" indicators.

In the first half of 2025, subsidized mortgage programs with interest payments at the expense of the client played a significant role, but as the key rate decreases, the basic loan products in many banks become more attractive, said Tatiana Shibanova, Sales Director at ASTERUS. At the same time, the family mortgage remains the most popular program among buyers.

"Clients are gradually getting used to the new conditions and are building their home purchase strategy, taking into account the cost of financing and possible changes in the market," she said. — Developers increase competition by improving the quality of projects, expanding infrastructure, offering additional services and more flexible terms of transactions.

When will the market situation improve

Sergei Zaitsev believes that it is not worth counting on a drastic increase in the availability of housing under construction. However, as the key interest rate decreases, the debt burden on developers will decrease, and they will have to compete with ready-made apartments on the secondary market in terms of prices, which should slow down the growth in the cost per square meter in new buildings.

"On the other hand, the recovery in demand for market mortgages will indirectly affect the primary market, as Russians will have the opportunity to sell their existing real estate to buy a new one," he said. — And in this regard, it is important to prevent a decrease in the pace of construction of new housing and a shortage of supply in the market, so as not to provoke further intensive growth in housing prices.

In order for apartments to become affordable, it is necessary to reduce mortgage rates under market programs, Natalia Shatalina noted. Then all citizens, not just individual categories, will be able to take out a loan with an acceptable monthly payment. According to the experience of previous years, mass demand returns to the market already at mortgage rates in the region of 13-15%.

Prices will continue to rise within the limits of inflation, but with a sharp decrease in the key rate and an increase in the availability of market mortgages, a faster increase is possible due to increased demand, she confirmed.

Mortgage programs can make the purchase of housing affordable for buyers in the first place, Konstantin Samedi added.

"Mortgage rates are still at a high level for many people right now," the expert noted. — At the same time, the family mortgage is becoming more targeted — proposals for the introduction of a differentiated rate are being considered, and from next year the program will be available only upon registration.

Housing affordability in the near future will be influenced by the macroeconomic situation, the key interest rate and government support measures, believes Evgeny Belokurov. Lower interest rates, the expansion of preferential mortgage programs and the introduction of new projects in popular segments are likely to slow down price growth and expand the choice for buyers. In general, it can be expected that with the easing of monetary policy in the coming months, a partial flow of money from deposits to the real estate market is possible, the expert believes.

Переведено сервисом «Яндекс Переводчик»