Considering finances: Colombia will join the BRICS Bank this year

Colombia intends to join the BRICS New Development Bank (NDB) in 2025, the Latin American country's ambassador Hector Arenas Neira told Izvestia. The decision on this issue was made after negotiations with the head of the NBR Dilma Rousseff, the diplomat stressed. The expert community emphasizes that Latin American countries are showing great interest in the NBR, especially against the background of increased trade duties from the United States. At the same time, the New Development Bank does not impose political conditions on countries for granting loans, unlike institutions such as the World Bank (WB) and the International Monetary Fund (IMF). Who else can join the structure in the near future — in the Izvestia article.

Colombia strengthens cooperation with BRICS

Colombia will join the New BRICS Development Bank this year, the Latin American country's ambassador Hector Arenas Neira told Izvestia.

— The decision has been made. Our president met with President of the BRICS Bank Dilma Rousseff in Shanghai," the diplomat said. — Colombia will join very soon, because this bank is open to all countries. We don't have to be a part of BRICS to join it. On the contrary, the bank provides access to economic resources and loans for infrastructure projects. I do not know the details, but it will happen soon.

President Gustavo Petro announced the launch of Colombia's accession to the New BRICS Development Bank on May 16.

"The project that had the greatest impact on the New Development Bank was a 120-kilometer railway or canal connection between the Pacific and Atlantic Oceans, which Colombia can build simply by connecting Uraba Bay with Cupica. I could bring together the whole of Atlantic South America," the Colombian leader said.

After the country joins the bank, it will be able to receive preferential loans for the implementation of projects in the fields of infrastructure, renewable energy, healthcare and other areas important for sustainable development. Colombia is ready to invest $512.5 million in the bank's capital, of which it will pay $102.5 million in a lump sum, and another $410 million as requested by the financial institution.

The Colombian Government is looking for alternatives to the International Monetary Fund and the World Bank to solve its financial problems and subsidize development projects. The advantage of the NBR is that it does not impose political conditions on countries for granting loans, emphasizes Timur Almukov, an expert on Latin America.

"The countries of the region are looking back at the experience of neighboring Argentina, which has been conducting long—term negotiations with the IMF on changing the terms of debt repayment, and they are beginning to be wary of this structure," he told Izvestia. — After a public skirmish with Donald Trump, when he threatened large-scale duties, Colombia actively talked about the need to diversify foreign trade and investment flows.

In line with this logic, the country recently joined China's Belt and Road initiative, the analyst noted.

— In addition, Beijing has previously financed infrastructure projects in the country, for example, the construction of the first branch of the metropolitan subway. This experience pushes the country's leadership to strengthen cooperation," he added.

Who else can join the NBR

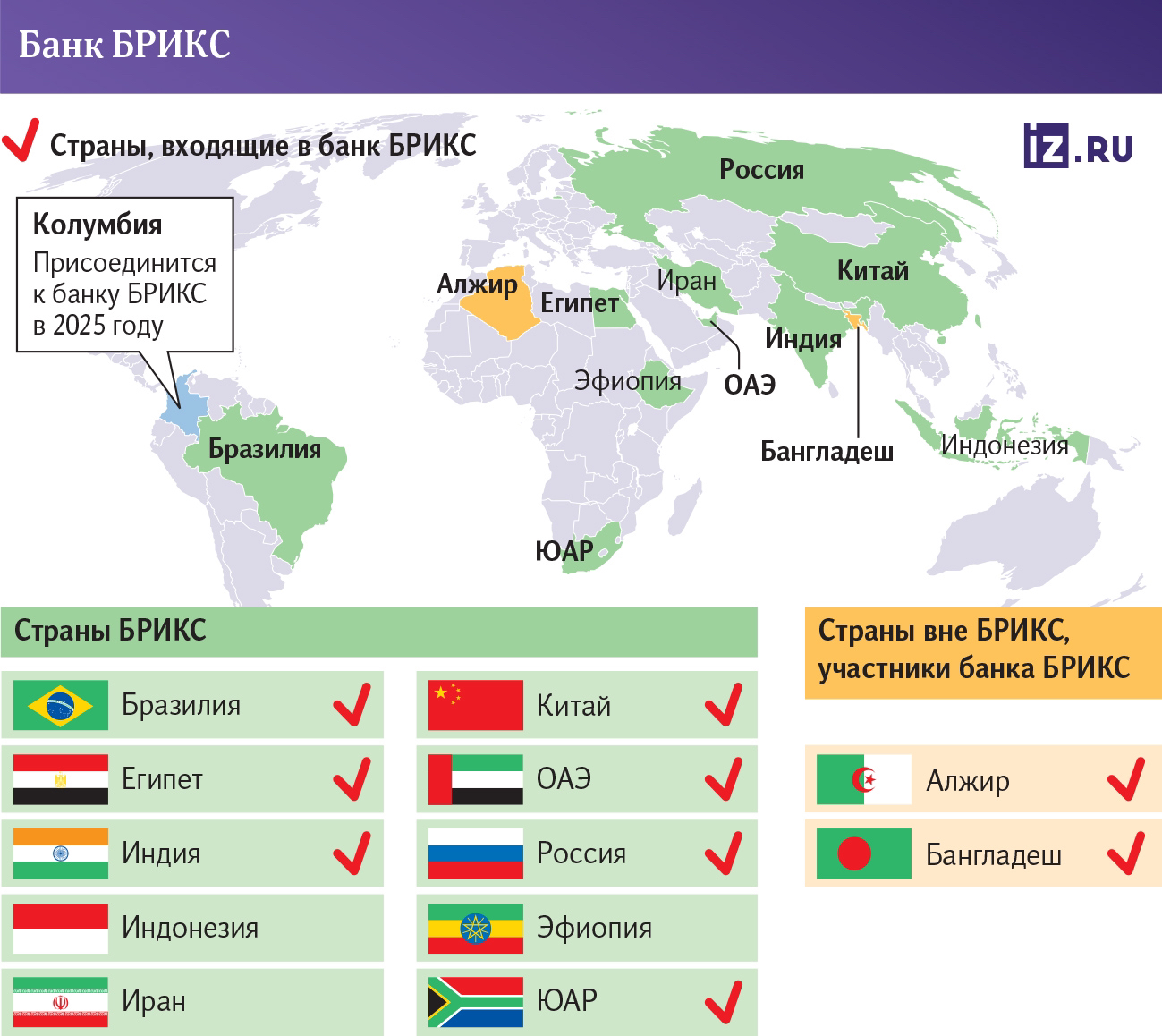

The expansion of the BRICS bank is taking place in accordance with the implementation of the NBR strategy for 2022-2026. Earlier, Bangladesh and the UAE (2021), as well as Egypt (2023) were admitted to the bank's member countries, founded in 2014 by Brazil, India, China, Russia and South Africa. Uruguay is in the process of paying its share in the capital. In March, the Russian Embassy in Montevideo informed Izvestia that the agreement on joining the New BRICS Development Bank was under consideration by the national Parliament of Uruguay.

On May 22, the NBR announced the accession of Algeria to the structure. The head of the bank, Dilma Rousseff, said that the country plays an important role not only in the economy of North Africa, but also at the global level, which "will certainly contribute to strengthening the position of the New Development Bank in the international financial arena."

—Algeria's accession will allow the NBR to expand the geography of its operations, diversify the bank's project portfolio and, consequently, credit risks, and deepen cooperation between the organization's member countries on the bank's activities," Igor Pilipenko, head of the Financial Cooperation and International Monetary and Financial System sector of the BRICS—Russia Expert Council, told Izvestia.

The gradual increase in the number of member states will allow the NDB to strengthen its weight among global and regional multilateral development banks, the analyst emphasizes. It will also provide an opportunity to more actively promote the financial and economic agenda in the interests of both Russia and developing countries in general, he is sure.

It is worth noting that the "new" BRICS members are particularly interested in the bank. So, in March, Indonesian President Prabowo Subianto announced that his country would join the NBR. Ethiopia also wants to become a part of the structure. The country's ambassador to Brazil, Leulseged Tadese Abebe, said earlier that Addis Ababa had already submitted a request to that effect. "We have received political support from all BRICS members and hope to complete the accession process very soon," the diplomat assured.

The weight of the BRICS bank is increasing

Initially, the NDB was considered as an alternative to the World Bank and other multilateral development banks with the largest shareholders from among Western countries. At the same time, in the agreement on the establishment of the NBR, its mandate was formulated more modestly: "... the mobilization of resources for infrastructure and sustainable development projects in the BRICS countries and other emerging market economies and developing countries to complement existing multilateral and regional financial institutions in order to achieve global growth and development," Igor recalled. Pilipenko.

Joining this institution is often easier than joining BRICS as a community, since states do not need the consent of all the countries of the association to do this. The Bank enables its participants to carry out significant infrastructure projects. For example, the NDB previously approved a loan of up to $50 million to the Brazilian state of Para to improve water supply infrastructure.

Russia also uses the bank's funds. Thus, the NBR will allocate about $1.2 billion in loans to it. The money will be used for four infrastructure projects that were frozen due to sanctions in 2022. Among them is the development of water supply and sanitation systems, the purpose of this project is to modernize the water supply system in cities off the banks of the Volga.

The NDB actively helps to implement significant infrastructure projects in developing countries. For example, it became known earlier that the bank plans to increase lending to Bangladesh development projects to $1 billion this year. We are talking about the implementation of a project to improve the stability of Dhaka's water supply.

In addition, the New BRICS Development Bank is committed to financing high-tech projects to advance global modernization. "BRICS has created the NDB, which is designed to play a crucial role in financing, including social and digital infrastructure, scientific research and technology industries," Dilma Rousseff, the head of the bank, said earlier.

— The NBR has ample opportunities to increase its attractiveness to the countries of the Global South, firstly, through the expansion of its shareholders, since the bank can carry out its operations only in its member countries. At the same time, it is necessary that the new participants have an independent position regarding the sanctions pressure from outside," Igor Pilipenko told Izvestia.

Secondly, the NDB may step up its work on providing funds in local currencies, which will contribute to the development of financial markets in developing countries, the analyst added. Thirdly, the bank has the resources to step up its work on providing technical assistance in the countries of operations, so that local clients acquire new knowledge and skills necessary for the effective implementation of NDB-funded projects, he added.

Vasily Sidorov, senior researcher at the Center for the Study of African Strategy at the BRICS Institute of Africa of the Russian Academy of Sciences, expert at the BRICS–Russia Expert Council, believes that the NDB could potentially become an alternative to institutions such as the IMF and the World Bank, but so far a limited number of members have joined the BRICS bank.

Thus, the analyst emphasizes that the participants of the BRICS bank are still issuing loans in US dollars, which in itself indicates the continued dominance of the United States in the global financial system at the current stage. However, the role of other countries' currencies in international settlements continues to strengthen. Since 2016, the Chinese yuan has been one of the world's reserve currencies and currently ranks sixth in the international reserves of central banks.

According to Russian President Vladimir Putin, the New Development Bank should become one of the main investors in the largest technological and infrastructure projects in the area of unification and the Global South. He noted that although the NDB is already presenting an alternative to a significant number of Western financial mechanisms, it will be developed "without opposing anyone."

Переведено сервисом «Яндекс Переводчик»