The payment is excellent: banks have begun to forgive Russians fines for delays

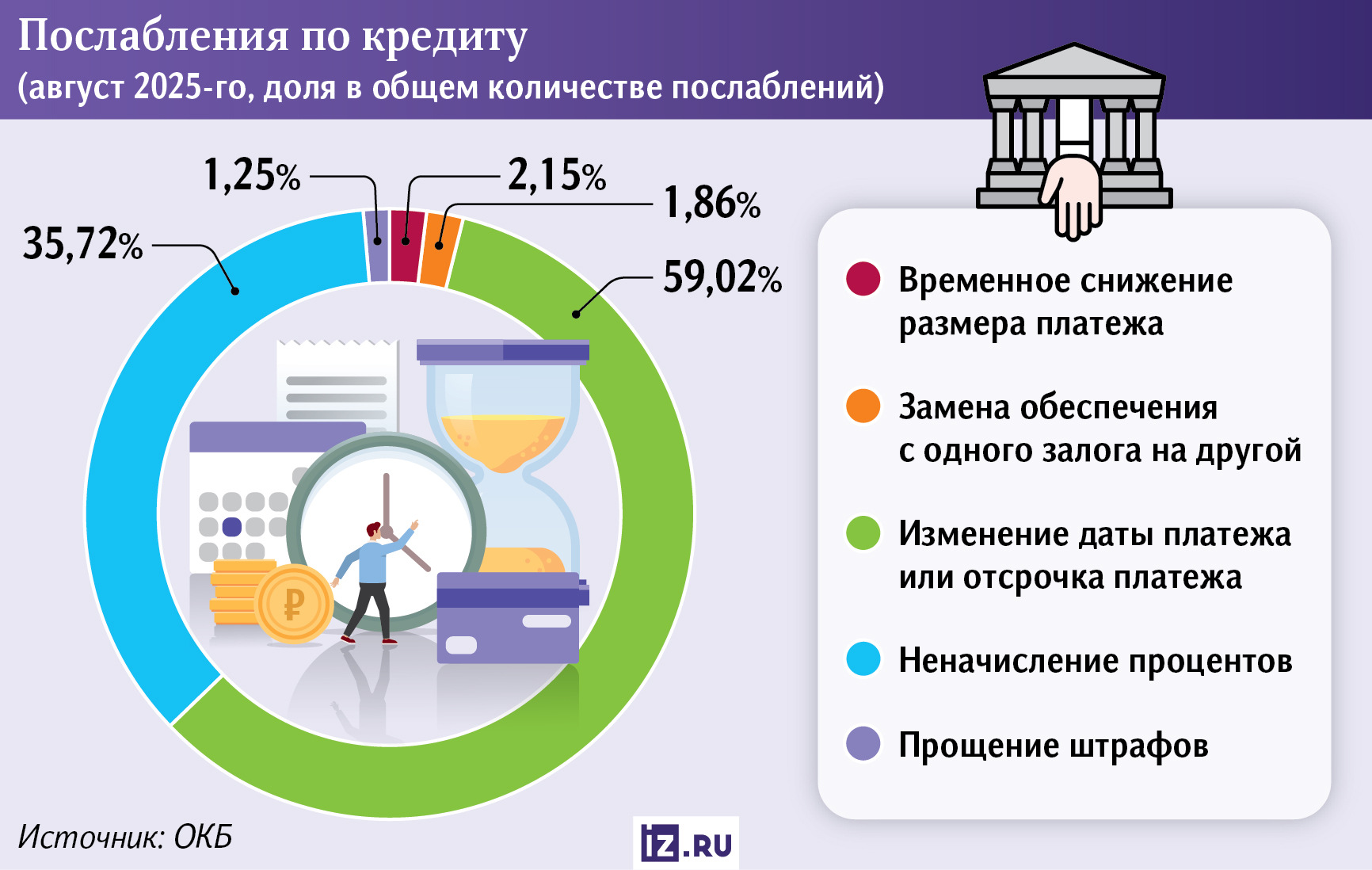

Banks began to forgive debtors fines for delay more often — the proportion of such cases increased significantly in 2025, according to the OKB data (available from Izvestia). This is done to avoid massive customer bankruptcies amid rising risks and the proportion of overdue debt. In addition, market participants do not charge interest for bad debts already in 36% of cases. At the same time, the loan restructuring mechanism that is needed to help such borrowers is not working well: financial institutions reject 80% of Russians' applications for easing conditions. Only those clients who find themselves in a difficult situation receive relief, for example, when faced with a drop in income.

How banks have changed their approach to debt restructuring

In recent months, banks have become noticeably more likely to forgive debtors fines for late payments, according to data from the United Credit Bureau (OKB), which was studied by Izvestia. The proportion of such cases increased from 0.01% over the years to 0.6–1.25% in the first half of 2025. In addition, non-deduction of interest is already recorded in 36% of cases, whereas a year ago the figure was at the level of 20%.

The forgiveness of penalties and fines is a market practice of reducing the volume of delays that occur at an early stage, said Dmitry Dolzhenko, head of Consumer Lending Development at Ingo Bank. Often, the cost of court costs and the work of collectors exceed the amount of the fines themselves, said Oleg Abelev, head of the analytical department at the Rikom-Trust investment company.

Cancellation of accrued fines is a standard tool for reaching payment agreements with the debtor, said the Director of Customer Service and Collection at Dom Bank.Russian Federation" Kirill Malinovsky. This method is widely used, but the organization does not record an increase in the number of cases of its use. Izvestia has sent inquiries to other major market players.

The loyalty of financial institutions can be explained by the growing risks in the system and the desire to avoid bankruptcy of customers. Earlier, the Central Bank reported a deterioration in the quality of mortgage and car loan services in the first half of 2025. The press service of the regulator told Izvestia that the share of loans overdue for more than 90 days on car loans has already reached 4%, and on mortgages — 1.1%.

In 2025, citizens began to apply for loan relief much more often. The number of applications for vacations in the second quarter increased 2.2 times compared to the same period in 2024, to 233.8 thousand. For mortgage holidays, the indicator jumped by 30% (to 6.5 thousand), and the number of applications for restructuring under banks' own programs increased by 87%, to 1.5 million, the Central Bank added.

Debt restructuring is a relaxation of the terms of the agreement for the borrower. One of the options is credit holidays. The authorities have launched this mechanism for consumer loans since 2024. According to it, the borrower can apply for a delay in repayment of the debt for up to six months. No fines are charged during this time, and the bank is not entitled to collect the collateral.

However, in April – June 2025, financial institutions rejected 80% of Russians' applications for debt restructuring and vacations, the Central Bank's press service previously told Izvestia. They clarified that a year earlier, the share of loans for which market participants agreed to ease conditions was higher — 31%. The main reason for refusals to provide credit and mortgage holidays is the lack of legally established documents confirming the deterioration of the living situation, the Central Bank replied.

The stage of delay is also an important factor for a credit institution when deciding whether to grant holidays, said Alexander Kulinich, Director of the Department for dealing with problem Loans at Renaissance Bank. To increase the likelihood of a restructuring being approved, you should contact the lender even before it occurs: the sooner the client submits an application, the higher the chances of a positive decision, he stressed.

Why banks often refuse to ease credit conditions

The growing share of cases of fine forgiveness and non-payment of interest indicates that the entire financial market is gradually moving towards environmentally friendly collection, which puts an individual approach to the client at the forefront, the press service of the National Association of Professional Collection Agencies (NAPCA) noted. In this case, clients enter into a dialogue with the creditor, rather than going into bankruptcy. As a result, the borrower can re—enter the payment schedule, and the bank can receive regular payments.

"It is much more profitable for any lender to have a borrower who has restored solvency in the portfolio than a bad debt," said Evgenia Lazareva, head of the Popular Front for Borrowers' Rights project.

The bank can forgive fines and not charge interest so that the debtor can at least start paying off the principal debt, said Oleg Abelev from Rikom-Trust. It's more important for him to get at least some of the money than nothing at all. In addition, the Central Bank actively recommends financial organizations to show loyalty to bona fide borrowers who are in difficulties. This approach helps to preserve the client and maintain financial stability.

It is important that fines are often not charged on loans where most of the amount has already been repaid, Evgenia Lazareva noted. Keeping such a debt on the balance sheet, selling it or collecting it is more expensive than meeting the customer halfway and maintaining his loyalty. This approach allows the bank not to lose reliable customers and reduce the cost of collection and possible losses. However, financial organizations are not obligated to make concessions, and borrowers should not count on it.

The authorities have introduced special mechanisms that allow clients in difficult circumstances to resume their ability to pay — credit holidays. But even there, Russians can get a postponement only if their situation fits all the criteria.

The borrower can request such relief once if he has suffered in an emergency, and once if his income has decreased. In the latter case, the client must prove that his income has decreased by more than 30% in the last two months compared to the average level of the previous year. However, there is another limitation — the loan amount should not exceed the level established by law (for example, for a cash loan — no more than 450 thousand).

Banks also provide their own debt restructuring programs. The most popular option is to extend the loan term to reduce the monthly payment. Borrowers can also apply for a reduction in the interest rate. This is possible, for example, if the Central Bank lowered the key rate during the loan period and market participants also lowered interest rates on loans.

At the same time, the high percentage of refusals to restructure (about 80%) is explained by the fact that banks carefully evaluate each client: they are ready to meet only those who have a real chance to start paying again, Oleg Abelev noted. This is not a contradiction, but a deliberate strategy — to weed out hopeless cases and offer easier conditions only to those who are able to restore their ability to pay.

If the analysis of the borrower shows that he is able to repay the loan without delay, the financial organization will not change the payment schedule and make concessions to him, said Dmitry Dolzhenko, a representative of Ingo Bank. If the client is not faced with a drop in income or a difficult life situation, the bank may well not meet him halfway.

Up to 80% of applications for restructuring and vacations are rejected because many borrowers overestimated their capabilities, took out loans at high rates and are now overdue, explained Evgeniya Lazareva. They relied on the bank's programs, but did not study the conditions, did not apply correctly, or simply did not meet the requirements. People often apply after the start of the delay, although there are more chances if you negotiate with the lender in advance, when difficulties first appear.

— Banks are not charities, so they help those who make sense to help. And there is a large stratum of borrowers for whom restructuring will no longer help," Oleg Abelev concluded.

Nevertheless, in the future, the liberalization of banks' restructuring policies is likely to continue, the expert believes. In any case, the number of bankruptcies may also increase, because risks are accumulating in the system and more and more Russians are delinquent on loans.

Переведено сервисом «Яндекс Переводчик»