In our profit shelf: oil and gas revenues of the Russian Federation in 2025 may decrease by 23%

- Статьи

- Economy

- In our profit shelf: oil and gas revenues of the Russian Federation in 2025 may decrease by 23%

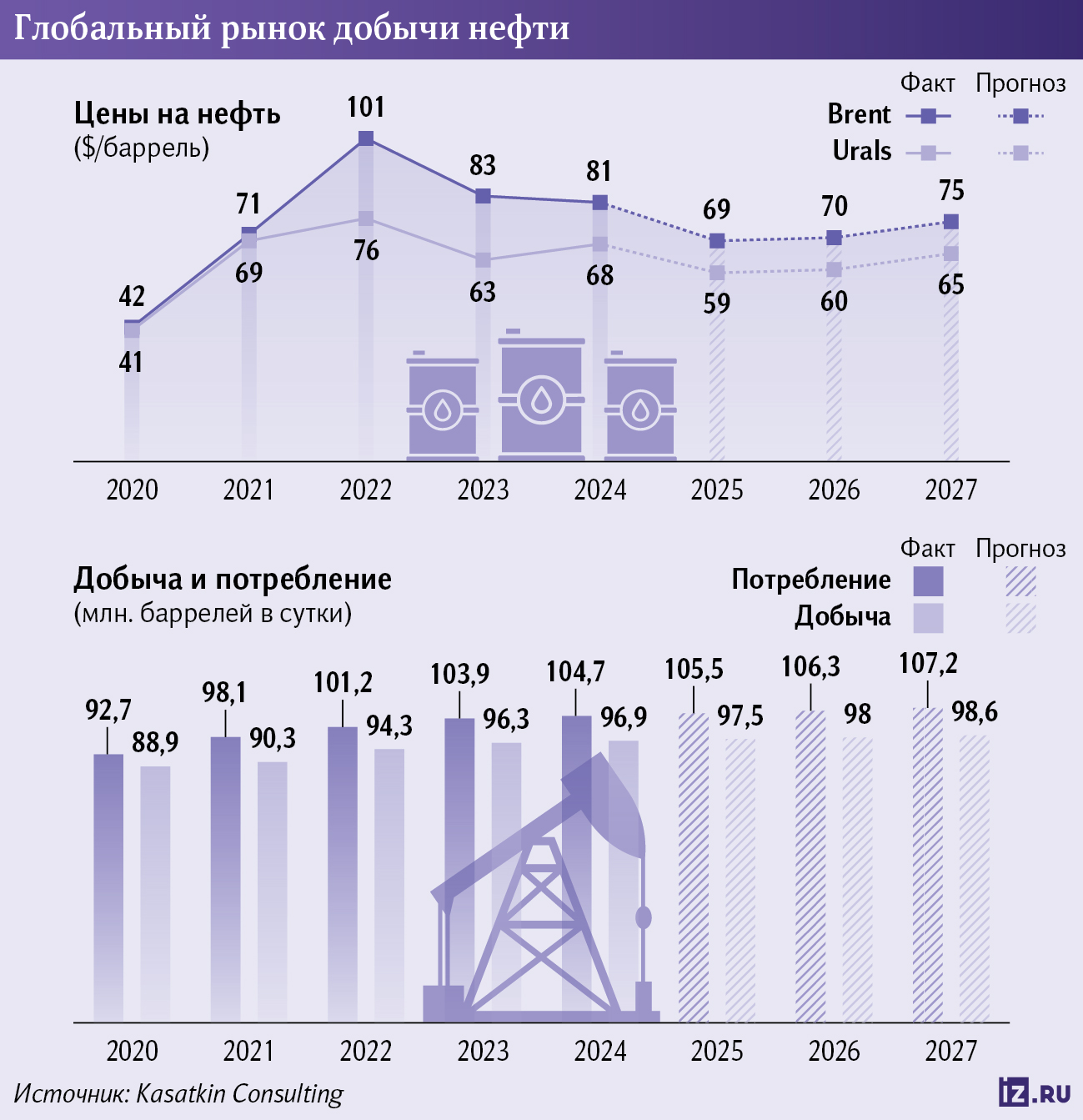

The fall in world oil prices and the strengthening of the ruble will lead to a decrease in Russia's oil and gas revenues in 2025 by 23% compared to 2024, according to a review by Kasatkin Consulting. However, next year, according to industry analysts, this figure will grow by 19%. The increase in budget revenues will be influenced by a decrease in the discount on Russian oil and, possibly, the Central Bank's rate to 10-12% by the end of 2026, experts believe. How the Russian oil and gas industry will develop in the near future is described in the Izvestia article.

How Russia's oil and gas revenues will decrease in 2025

By the end of this year, Russia's oil and gas revenues will decrease by 23% compared to 2024. This is the conclusion reached by experts from Kasatkin Consulting in their annual review of the production and oilfield services markets (available from Izvestia). At the same time, according to their forecasts, in 2026 these revenues will grow by 19% compared to 2025.

According to Dmitry Kasatkin, Managing partner of Kasatkin Consulting, 2025 turned out to be the most difficult year for the export-oriented raw materials sector of the economy, and the oil and gas industry is no exception.

— A strong ruble and low oil prices are the main reasons for this situation. In 2026, we expect the ruble to weaken, as well as an improvement in the situation due to the Central Bank's policy, which will also stimulate the oil and gas industry. We do not include geopolitical changes in the forecast due to high uncertainty," he said.

The expert added that he expects the Central Bank's rate to reach 15-16% by the end of 2025, and 10-12% by the end of 2026. At the end of July, the Central Bank had already lowered its key rate from 20% to 18%.

According to the consensus forecast of the Center for Price Indices (CIC), analysts expect the ruble to weaken by the end of the year, but forecasts are becoming more moderate — 87.8 rubles per dollar, after 94 rubles in the June survey. The Central Bank also noted that after reducing the key rate by 2 percentage points on July 25, analysts expect a slowdown in its decline at the upcoming three meetings before the end of the year. As a result, it may be reduced to 14-16% by the end of 2025.

In July, according to the Ministry of Finance, oil and gas revenues amounted to 787.3 billion rubles, which is 27% less than in July 2024. Since the beginning of the year, they have amounted to 5.52 trillion rubles, while for the whole of 2024 — 11.13 trillion rubles. At the same time, the ruble has strengthened by more than 20% since the beginning of the year.

In turn, the Ministry of Economic Development lowered expectations for the price of Russian Urals crude oil from $69.7 to $56 per barrel in its April forecast. In 2026, the agency expects $ 61 per barrel, and in 2027 - $ 63. As for Brent crude, the ministry's experts predict that its price will be $68 per barrel this year and $72 in 2026-2028.

As explained to Izvestia in the press service of the Ministry of Economic Development, estimates of the main macroparameters, including energy prices, will be updated in the forecast of socio-economic development for 2026-2028, which will be presented in September.

Analysts at Kasatkin Consulting also note that the negative price environment for the global oil market will continue in the next two years. According to their forecasts, the average price of Brent will be $69 per barrel this year, $70 in 2026, and prices may rise to $75 per barrel only in 2027.

— In the long term, we do not consider geopolitics to be a decisive factor. We believe that the lifting of sanctions and restrictions on Russian oil could potentially cause a short-term decline in prices, but fundamentally it will have a neutral effect on the market, apart from reducing the discount to Urals. We do not expect a reduction in pressure on the Russian oil and gas industry from Western countries until 2027," said Dmitry Kasatkin.

Sergey Tereshkin, CEO of Open Oil Market, believes that oil and gas revenues will stabilize at July levels, since the Urals price will not decrease relative to current values.

According to him, the average Urals price in 2025-2026 will be above $50 per barrel, but the actual value will depend on the size of the discount to Brent, which currently stands at about $10 per barrel. This forecast is based on the fact that the price of Brent will balance near the mark of $ 65 per barrel.

What kind of oil production can be expected in Russia

By the end of 2025, the volume of oil production will be able to be maintained at the level of 516 million tons in 2024, and the level of 515 million tons is expected to remain until 2027, Kasatkin Consulting experts note in their report.

— This is due both to the external environment, which translates into OPEC+ policy, and to an increase in the share of hard-to-recover reserves and a decrease in the number of profitable reserves in mature fields. This translates into the long—term strategies of the largest subsurface users — to maintain the current production level," notes Dmitry Kasatkin.

Recall that, according to the targets of the Energy Strategy until 2050, in order to maintain Russia's position in the foreign market and stably supply the domestic one, oil production should reach 540 million tons per year by 2050.

According to Dmitry Kasatkin, the energy strategy is a document that is a guideline and a vector, but not a production goal in the current conditions.

"In general, even in the current conditions, it is realistic to achieve such an indicator within six months, but this will require an increase in investments by 25-30%, as well as their effective distribution in the most profitable fields," the source notes.

He stressed that the potential of Western Siberia has not been exhausted to a large extent and it is possible to drill an additional 20-25 million tons there, "but for this, appropriate conditions must be created for oilfield services, primarily in terms of financing."

According to Sergey Tereshkin of Open Oil Market, oil production in Russia in 2026 will be higher than in 2025, and even more so than in 2024, however, the actual growth rate will depend on an increase in OPEC+ quotas.

— According to the IEA, Russia can increase production by 100,000 barrels per day in a short period of time without significant investments, simply by using idle capacities. This is slightly less than 5 million tons of oil per year," the source said.

According to the CEO of the Independent Analytical Agency of the Oil and Gas Sector (NAANS-Media) According to Tamara Safonova, if the trends in the first half of the year continue, by the end of 2025, oil and gas condensate production in Russia may range from 506 million to 517 million tons.

"The change in production volumes may be due to the fulfillment of the main and additional obligations under the OPEC+ deal and the degree of further increase in oil production against the background of decisions to stabilize the global oil market," the analyst believes.

Izvestia sent inquiries to the Ministry of Finance and the Ministry of Energy.

What will happen to exports and profits of oil companies

The volume of Russian exports in 2025 will remain at the level of 2024, according to a survey by a consulting company. As previously noted by Deputy Prime Minister Alexander Novak, last year it amounted to 240 million tons.

Tamara Safonova agrees with her colleagues' forecast. According to her, oil exports (by pipeline and sea transport) can be estimated at the level of 235-245 million tons by the end of 2025, taking into account the downward trend in exports in the first half of the year and the forecast for its gradual increase in the second.

At the same time, as noted in the Kasatkin Consulting review, by the end of 2025, companies' revenue in dollars will decrease by 13% and in rubles by 10%. Despite this, investments in exploration and production in 2025, denominated in dollars, will grow by 7%, in rubles — by 3.5%.

According to experts, the average cost of production will grow from $8 in 2024 to $10 from 2025 to 2027.

— As for the cost of production, so far we can talk about the total costs of oil production and export — from extraction at the well to shipment at the ports of importing countries. And here the costs are likely to decrease due to the improvement of the geopolitical background. This includes, among other things, the cost of transporting raw materials using a shadow fleet. Their reduction will have a beneficial effect on the net profit of oil companies," notes Sergey Tereshkin.

In general, according to Ekaterina Kosareva, Managing partner of VMT Consult, the prospects for the development of the domestic oil industry are based on fundamental factors, without taking into account geopolitics.

— All other things being equal, both Russian oil production and exports will remain at current levels. External pressure did not affect the volume of supplies, but only changed their routes," she said.

The only exception is gas exports, but there are no plans to significantly increase them in the next year or two, even despite the possible easing of sanctions, the expert concluded.

Переведено сервисом «Яндекс Переводчик»