- Статьи

- Economy

- On all 110: the authorities have identified an undesirable dollar exchange rate for the economy

On all 110: the authorities have identified an undesirable dollar exchange rate for the economy

The authorities called the dollar below 75 and above 110 rubles one of the strategic risks for the Russian economy — this could affect the achievement of national goals, Izvestia learned. The Cabinet instructed to compile a list of such risks. In addition to the exchange rate, the Ministry of Economic Development identified the following problems: a key rate above 16%, low global and export prices for energy, wheat and metals, a reduction in exports to India and China, tougher control over compliance with sanctions, population reduction and outflow, and others. For more information, see the Izvestia article.

Which dollar exchange rate is undesirable for the economy

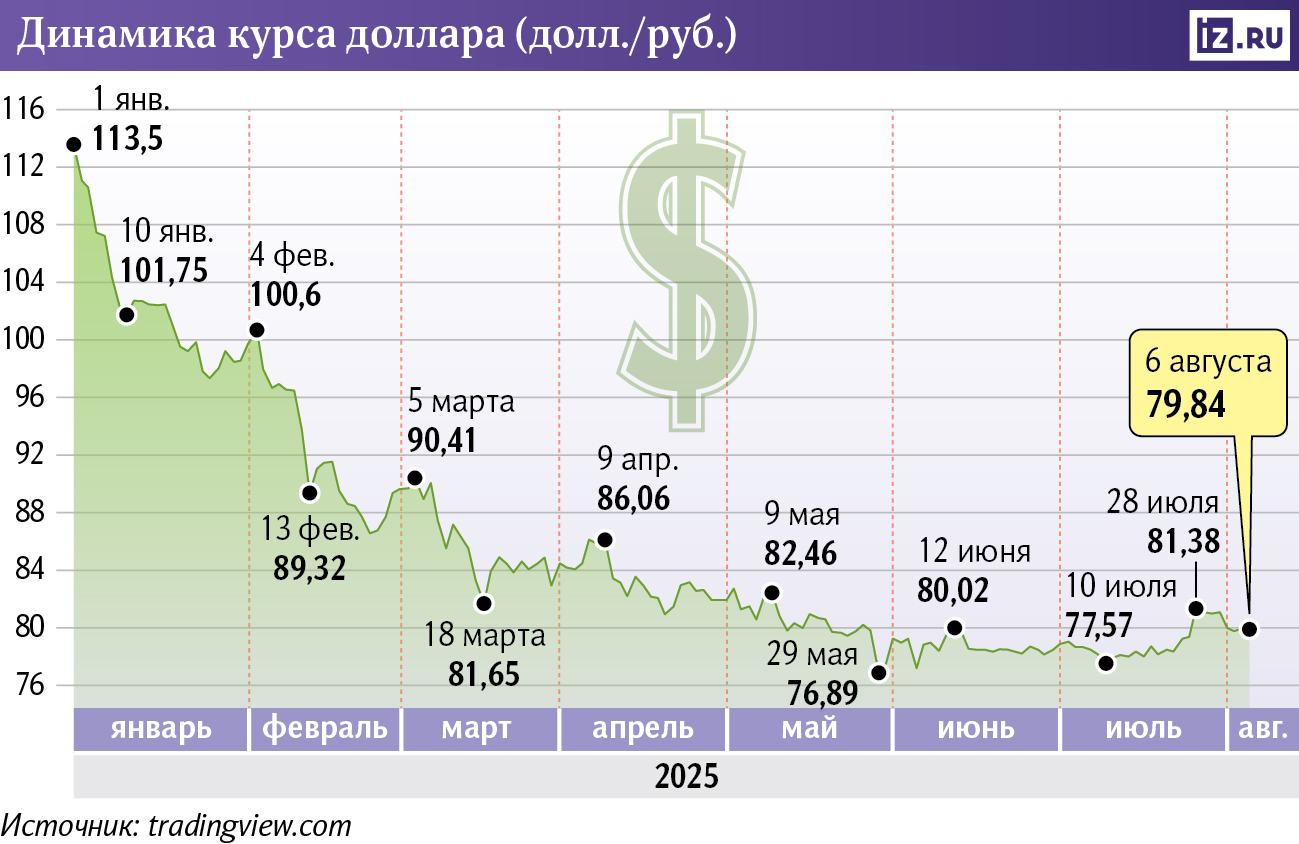

Excessive volatility of the Russian currency is described as one of the strategic risks of meeting the country's national goals. The Ministry of Economic Development (MAYOR) called the undesirable rate below 75 and above 110 rubles, the average risk is below 85 and above 100 rubles. This follows from the list of strategic risks attached to the letter from Polina Kryuchkova, Deputy Head of the Ministry of Economic Development, sent to the government and relevant departments (Izvestia has it).

According to the document, we are talking about the risks of fulfilling such national goals as preserving the population, improving health and well-being of people, supporting families; realizing the potential of each person, developing their talents, nurturing a patriotic and socially responsible personality; a comfortable and safe living environment; a stable and dynamic economy; technological leadership.

Izvestia's source in government agencies explained that later, measures to prevent these risks may be developed in the Mayor's office.

The Decree on national goals was signed by Russian President Vladimir Putin in May 2024. For each of the goals, clear indicators and tasks have been identified to be completed by 2030 and for the future of 2036, respectively. They were previously announced as national projects during the address to the Federal Assembly. The document defines Russia's goals for preserving the population, strengthening health and improving people's well-being, ensuring a comfortable and safe life for citizens, achieving sustainable and dynamic economic growth, as well as technological leadership and digital transformation.

However, socially significant areas of government policy can be affected only to a small extent, according to the Ministry of Economy: the exchange rate can only indirectly affect the development of individual digital platforms, attracting international students, and increasing housing affordability. To a greater extent, the situation with currencies affects the economic indicators and issues of technological equipment of the country, it follows from the materials.

For example, there are indirect risks to GDP growth above the global average, as well as a decrease in the share of imports of goods and services in its structure, attracting investment, increasing the volume of tourism and agro-industrial sectors, the development of technological cooperation by Russia and the development of new markets. This may affect almost all indicators of technological leadership — it will be more difficult for the Russian Federation to ensure the introduction of new developments in the digital sphere, transport, energy, and so on.

According to the Central Bank on August 6, the exchange rate of the Russian currency was 80.19 rubles per dollar, which has strengthened by almost 25% since the beginning of the year. The strengthening of the national currency is worse for our economy than a weak ruble, Dmitry Belousov, head of the department of analysis and forecasting of macroeconomic processes at the Central Research Institute of Economics, told Izvestia. An undervalued exchange rate greatly unbalances the incomes of exporters, he noted.

The expert drew attention to the fact that there is now an extremely unusual combination of a strong ruble and fairly low world prices for most commodities. This is hitting the budget — it was designed at the same time with a higher cost of energy resources and a weaker ruble, he added. However, in the updated financial plan, the authorities adjusted the forecast of the ruble exchange rate from 96.5 to 94.3 rubles per dollar.

Izvestia sent requests to the Ministry of Economic Development, the Ministry of Finance and the Central Bank.

Too weak a ruble exchange rate implies restrictions on the import of various goods and services, in particular technological equipment, the director of the Institute of National Economic Forecasting (INP) told Izvestia RAN Alexander Shirov. The population also suffers from this: it is more difficult for people to buy foreign goods and services. At the same time, the main problem lies in the strong volatility of the national currency. A sharp exchange rate drop is a destabilization for many investment processes, the chief economist of the VEB state Corporation added.Russian Federation Andrey Klepach.

— A detailed study in the government of the possible risks of not achieving the indicators of a single plan of national goals indicates a comprehensive and systematic approach of the country's leadership to the implementation of all those key tasks outlined by the president. It is obvious that the key needs of security and a comfortable life for our citizens will be provided regardless of the global economic situation and attempts to exert external pressure on Russia," Yuri Fedorov, first deputy chairman of the Federation Council Committee on Economic Policy, explained to Izvestia.

However, according to him, it cannot be denied that the success of solving many tasks of technological modernization, industrial renewal and economic diversification really depends to a large extent on the foreign trade of the Russian Federation, income from exports, supplies of energy and other resources. That is why relevant agencies should assess the future risks of changes in the situation on world markets and sanctions pressure and prepare a clear plan for financial and economic policy, as well as possible responses to challenges, the senator noted.

The list of external economic risks indicates the continued dependence of the processes taking place in Russia on world events, partly for objective reasons due to the globalization of many sectors of the world economy, said Yuri Stankevich, Deputy Chairman of the State Duma Committee on Energy.

— On the other hand, dependence needs to be reduced by solving the problem of technological sovereignty and creating added value in export-oriented sectors of the economy, including the fuel and energy complex. Sustained demand for products of deeper processing in comparison with raw materials in both domestic and foreign markets will increase the flexibility of the domestic economy to global shocks, whatever they may be caused by," the parliamentarian said.

What factors can have a negative impact on the economy?

The Ministry of Economic Development in the document also drew attention to the tight monetary conditions in the country: in particular, the key rate above 16% per annum may have a negative impact on economic performance.

From October 2024 to June 2025, the Bank of Russia kept the rate at a record high of 21% per annum. In early summer, he began to ease monetary policy and lowered the key one for the first time in three years. At the last meeting on July 25, the regulator lowered the rate immediately by 2 percentage points to 18%. As Izvestia wrote, by the end of 2025, it may be reduced to 14-15%.

As Alexander Shirov from INP RAS explains, in the context of excessively tight monetary policy, demand and lending volumes are beginning to slow down sharply. Ultimately, this leads to the fact that demand may fall below equilibrium values, which means that the economy is gradually being dragged first into a slowdown in economic growth, and then, possibly, into recession.

— The current key rate is holding back the development of the economy today. The Bank of Russia does not hide the fact that it is restrictive and prohibitive in nature. As a justification, the argument is used that inflationary expectations play a special role in transmitting a signal about monetary policy to the economy. Based on the inflation target of 4%, the optimal rate option that can have a beneficial effect on investment processes in the domestic economy is 6-7%. This is what regulators should strive for next year," believes Yuri Stankevich.

The MAYOR's list of strategic risks also includes a slowdown in the economies of China and India and a decrease in Russian exports to these countries.

The relative slowdown in the Chinese economy has already affected oil prices, which have been below forecasts in recent years precisely because China has not returned to the growth rates that were characteristic of it before the pandemic, said Valery Andrianov, associate professor at the Financial University under the Government.

— Currently, there are no prerequisites for a further slowdown in the Chinese economy. It seems that the trade war with the United States is at least postponed, the American leader Donald Trump is trying to negotiate with Beijing. Therefore, China is not expected to have a further negative impact on oil prices. As for a hypothetical reduction in Russian oil supplies to India and China, this would be an unpleasant factor for the economies of both the Russian Federation and our partners. But this is unlikely to happen in practice. Firstly, both of these countries have already stated that they do not intend to abandon Russian oil under pressure from Washington. Secondly, Trump is unlikely to impose secondary sanctions against them precisely because of their cooperation with Russia," the expert believes.

There are already many problems in the US-Chinese and US-Indian relations that need to be resolved, and Russian oil here acts as one of the elements of political bargaining, and not the reason for the introduction of some kind of total sanctions, concluded Valery Andrianov.

Переведено сервисом «Яндекс Переводчик»