- Статьи

- Economy

- Policy shift: as in 16 regions of Russia, the CTP price turned out to be higher than the national average

Policy shift: as in 16 regions of Russia, the CTP price turned out to be higher than the national average

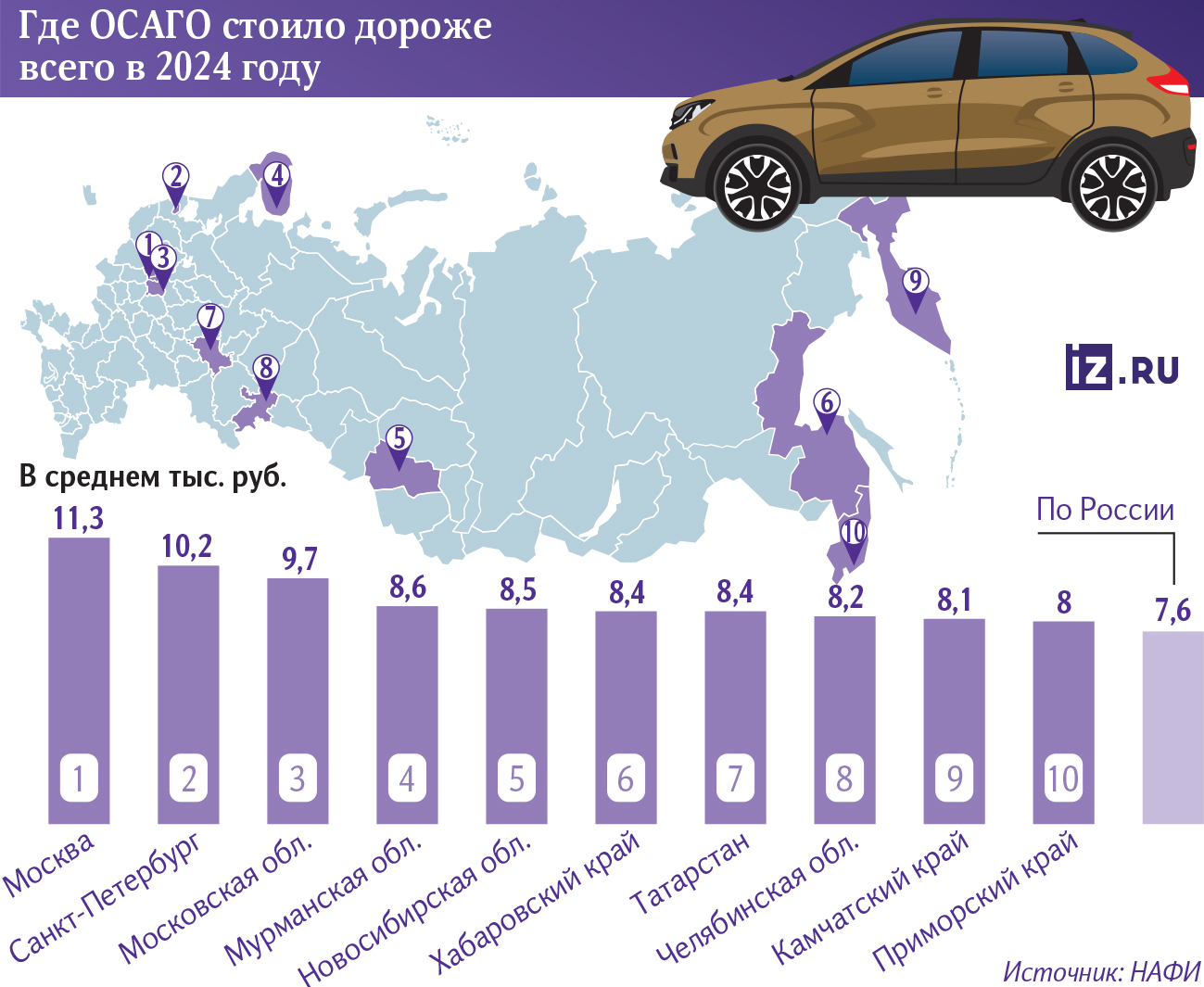

In 16 regions of Russia, the CTP price was higher than the national average. A year ago, there were 13 of them, according to a study by NAFI (Izvestia studied it). This happened against the background of a general decrease in the average cost of the policy. A significant factor in the price increase, which influenced the price increase, in addition to the level of income and accidents, was the activity of fraudsters. Losses from their actions increased by 20% over the year. The five subjects with the most expensive policies included Moscow, St. Petersburg, Moscow, Murmansk and Novosibirsk regions, and Novosibirsk was the only one that appeared in two ratings at once — in terms of high cost and level of insurance fraud, reflecting the high level of fraud in this region, affecting the growth of the cost of CTP in the whole country. How they most often cheat with policies and what will happen to CTP prices next — in the Izvestia article.

In which regions are CTP prices rising?

Last year, the average cost of CTP in Russia decreased by 200 rubles compared to 2023, to 7.6 thousand. However, the number of regions where insurance turned out to be more expensive than the national average has increased: 16 instead of 13. This is stated in a study by NAFI and Businessdrome based on data from the Central Bank, VSS and Rosstat (Izvestia has reviewed the document).

The increase in prices affected Moscow, the Moscow region, St. Petersburg, as well as the Murmansk and Novosibirsk regions: in these regions, the price of the policy reached 8-11 thousand rubles.

Such deviations in the cost of CTP are explained by several factors at once, the report notes.

Firstly, it is a high level of income. In regions where residents earn more, drivers are more likely to buy cars with powerful engines, and this directly affects the price of the policy. In addition, high-income subjects attract young people. And young drivers are traditionally considered more risky, so insurance is more expensive for them. Moscow, St. Petersburg and the northern regions are the leaders in these indicators.

Secondly, it is an accident rate. The more frequent accidents occur, the higher the insurance benefits. These risks are taken into account in the territorial coefficient when calculating the cost of CTP. Among the most affected regions are Moscow, Krasnodar Krai, Nizhny Novgorod Region, St. Petersburg and the Moscow region.

Where are the most insurance scams

Another important factor affecting the cost of CTP is the level of fraud. In regions with high activity of fraudsters, insurers include potential losses in the price of the policy.

The study identified regions where last year there was a high proportion of criminal damage and the risk of unfair actions.

Thus, the Novosibirsk Region, Ingushetia, North Ossetia, Smolensk Region, Karachay-Cherkessia and Primorsky Krai turned out to be the most problematic from this point of view. Dagestan, Altai and Chechnya are also included in the rating.

As a rule, a high level of fraud should increase the price of CTP in the region. But in practice, this is not always the case: in six out of eight problem subjects, the policy is cheaper than the average. For example, with an average price of 7.6 thousand in Ingushetia, it amounted to 6.1 thousand, in the Smolensk region — 6.4 thousand, in North Ossetia — 6.7 thousand, NAFI analysts calculated.

At the same time, the Novosibirsk Region is the only region that got into two ratings at once: with the highest CTP prices and with an impressive level of fraud. This may indicate that illegal schemes here really affect the cost of policies.

—The Novosibirsk Region belongs to the Central Bank's "red" zone of regions with a high risk of unfair actions in CTP and high loss—making of this type of insurance," said Yuri Strekalov, Director of the CTP Portfolio Development at PJSC IC Rosgosstrakh.

According to a NAFI study, the amount of losses from insurance fraud increased by 20% last year. At the same time, CTP remains the most problematic segment: it accounts for about 90% of all applications.

What CTP schemes are used by scammers

Indeed, "anomalies" persist in a number of regions: in particular, the national average rates of occurrence of insurance claims and their recurrence, as well as the average payout, were significantly exceeded, confirmed Yuri Strekalov from Rosgosstrakh. All this indicates unfair actions and outright fraud.

In particular, the Novosibirsk region is also leading due to the increased values of the sample indicator based on the "repeatability" of CTP losses per car — 12.3% (3.8 times higher than the national average), according to monitoring data from the Central Bank.

Fraud occurs both on the part of insurance companies and on the part of citizens, said Yulia Kovalenko, Associate Professor of the Basic Department of Financial Control, Analysis and Audit at Plekhanov Russian University of Economics.

— There are different schemes on the part of citizens: someone is trying to get a payment without an insured event, someone is deliberately provoking an accident. Since under CTP you can either give the car for repair or get money, scammers usually choose the second option," she shared.

And in order not to get on a fake policy, the purchase should be checked through the portals of the Russian Union of Motor Insurers (RSA) or the National Insurance Information System, especially if registration takes place online, where phishing sites are possible, Yulia Kovalenko advised.

Unscrupulous insurance companies and agents often inflate the cost of the policy for the driver in order to maximize profits, added Natalia Milchakova, a leading analyst at Freedom Finance Global.

Car washers use a variety of scenarios, from classic sudden braking and roundabouts to complex multi—pass combinations using previously damaged cars, Absolut Insurance shared. Increasingly, attackers operate in places without surveillance cameras and with poor lighting, they noted.

To combat fraud, insurers are actively cooperating with law enforcement authorities in the regions, said Roman Lobodin, director of the Department of compulsory types of insurance at AlfaStrakhovanie. Most often, falsification of accidents and fictitious circumstances of accidents are revealed.

Fraud is rampant for several reasons: weak countermeasures, limited opportunities for insurers to investigate, and special features of law enforcement, Sovcombank Insurance listed. Companies cannot always verify an insured event: they often do not have access to camera recordings, case files, and testimony from participants in an accident. At the same time, the penalties for such scams often do not correspond to the scale of the damage, they added.

What will happen to CTP prices?

From 2025 to 2028, the average cost of CTP in the country will grow by 2-15% per year (excluding short-term policies), NAFI analysts predict. The spread is greater by region — from 5 to 50%, although in some regions even a slight downward correction is possible.

An increase in policy prices in the coming years is likely in large cities, million-plus cities and regional centers, says Yulia Kovalenko from the Russian University of Economics. But in small municipalities, the cost of the policy may decrease due to freer traffic and lower accident rates.

— The CTP price is also influenced by external factors. For example, an increase in the exchange rate increases the cost of spare parts, which are often imported. The increased cost of logistics from abroad also affects the costs of insurers. In summer, price increases are possible in tourist regions such as Krasnodar and Stavropol territories, Volgograd and the region, Astrakhan and the Crimea. This is due to an increase in the flow of cars and risks on the roads," the expert estimated.

Alfa Insurance also believes that the trend towards lower CTP prices has reached its peak. At the same time, Rosgosstrakh does not expect a strong price increase. Due to the high competition, insurers are restraining tariffs for bona fide customers, and for unprofitable ones they are already applying maximum rates from the acceptable range, explained Yuri Strekalov.

Переведено сервисом «Яндекс Переводчик»